List of 11 Best Term Insurance Plans in India 2022

What you will learn in this blog post

- What is a Term Insurance Policy?

- List of 11 Best Term Insurance Plans in India 2021-22

- Factors to keep in mind before choosing a term insurance

Mr. Ranjan, aged 45 years, working with an IT MNC, lived with his wife, two kids, and parents in Bangalore. He had taken a term insurance policy for 1 crore, hoping to cover the financial commitments of his family after his absence. Due to frequent travel involved in his work, he contracted a COVID-19 infection, which spread to all his family members as well.

Despite all efforts by the doctors to keep his vitals stable, Mr. Ranjan died due to multiple organ failure and oxygen insufficiency. His family members recovered from COVID-19 but were devastated over his loss.

With the single earning member of the family no more, the future could have looked blurry for them, but thankfully, Mr. Ranjan had informed about his term plan to his wife, who then sent a claim request to the insurance provider and received the death benefit of Rs 1 crore.

Without his term insurance plan, Mr. Ranjan’s family would have had no other source of income to run their daily lives or pay for the kid’s education. Thus, a term policy is a helpful tool for anyone who prefers to secure the financial commitments of their dear and near ones, even after their demise.

Like in the example above, nobody can predict the future, but we can plan for it after understanding the risk factors. The COVID-19 pandemic spreading across the world and taking the lives of people is a classic example of how things can become uncertain very soon.

In such situations only, you need to look at ways of securing the financial condition for a better tomorrow through instruments like term life insurance. Let’s know more about this effective financial tool called term insurance.

What is a Term Insurance Policy?

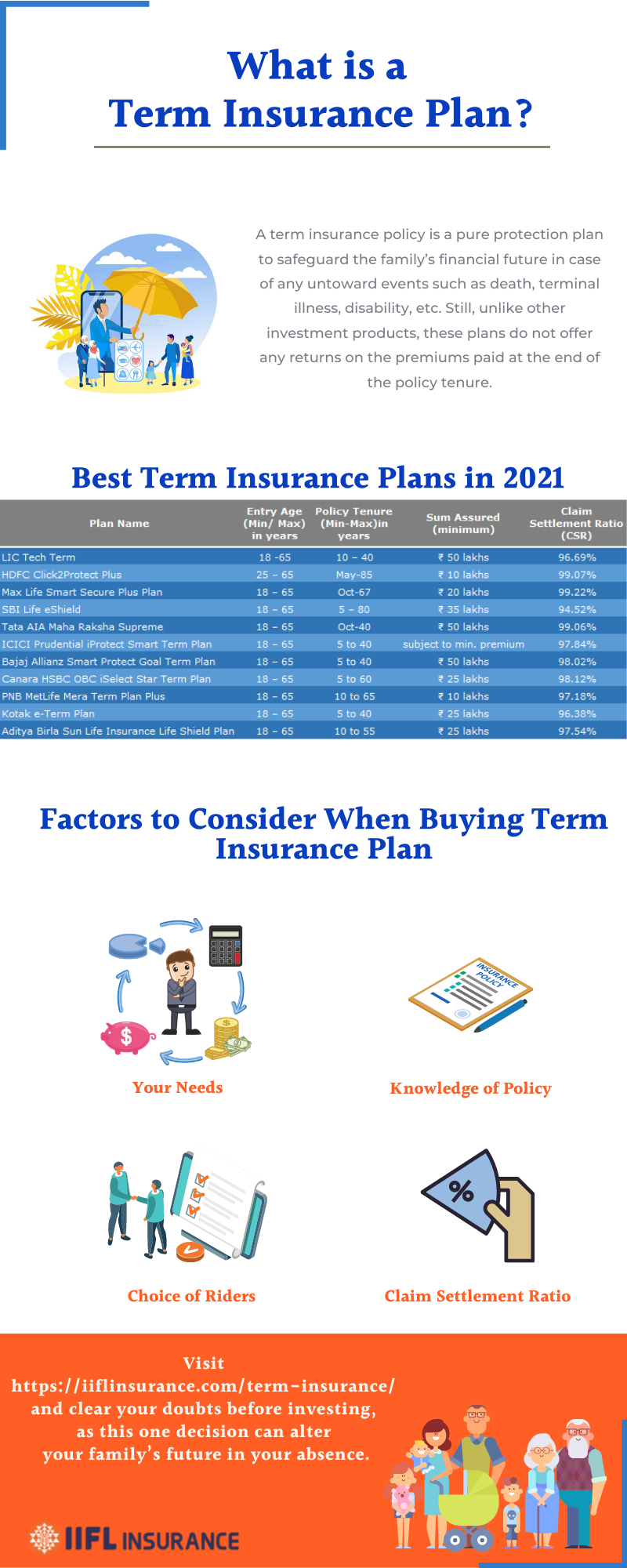

A term insurance policy is a pure protection plan to safeguard the family’s financial future in case of any untoward events such as death, terminal illness, disability, etc. Still, unlike other investment products, these plans do not offer any returns on the premiums paid at the end of the policy tenure.

So, if you are looking to buy a term plan, first you need to know the risks involved in your life, the number of dependents, and what amount would suffice for them to lead the same quality of life they are experiencing now after you pass away.

There are many insurance companies in the market, with each offering a wide range of policies to choose from. It is undoubtedly a big task to select the best term plan from this extensive list, but you must invest time and effort in the search as it guarantees peace of mind for you and a stress-free future for your family.

List of 11 Best Term Insurance Plans in India 2022

Here we listed out the 11 best term insurance plans in India from top term insurance companies for you to choose and buy the best term plan for your family in the year 2021 as mentioned below:-

-

- LIC Tech Term Plan

- HDFC Click2Protect Plus

- Max Life Smart Secure Plus Plan

- SBI Life-eShield

- Tata AIA Maha Raksha Supreme

- ICICI Prudential iProtect Smart Term Plan

- Bajaj Allianz Smart Protect Goal Term Plan

- Canara HSBC OBC iSelect Star Term Plan

- PNB MetLife Mera Term Plan Plus

- Kotak e-Term Plan

- Aditya Birla Sun Life Insurance Life Shield Plan

Best Term Plans in India

Here is the list of the 11 best term plans in India from some of the top-rated term insurance companies here, along with their salient features, for you to choose and buy in the year 2021-2022.

| Plan Name | Entry Age (Min/ Max) in years | Policy Tenure (Min-Max) in years | Sum assured (minimum) | Claim Settlement Ratio (CSR) |

| LIC Tech Term | 18 -65 | 10 – 40 | ₹ 50 lakhs | 96.69% |

| HDFC Click2Protect Plus | 25 – 65 | 5 – 85 | ₹ 10 lakhs | 99.07% |

| Max Life Smart Secure Plus Plan | 18 – 65 | 10 – 67 | ₹ 20 lakhs | 99.35% |

| SBI Life eShield | 18 – 65 | 5 – 80 | ₹ 35 lakhs | 94.52% |

| Tata AIA Maha Raksha Supreme | 18 – 65 | 10 – 40 | ₹ 50 lakhs | 99.06% |

| ICICI Prudential iProtect Smart Term Plan | 18 – 65 | 5 to 40 | subject to minimum premium | 97.84% |

| Bajaj Allianz Smart Protect Goal Term Plan | 18 – 65 | 5 to 40 | ₹ 50 lakhs | 98.02% |

| Canara HSBC OBC iSelect Star Term Plan | 18 – 65 | 5 to 60 | ₹ 25 lakhs | 98.12% |

| PNB MetLife Mera Term Plan Plus | 18 – 65 | 10 to 65 | ₹ 10 lakhs | 97.18% |

| Kotak e-Term Plan | 18 – 65 | 5 to 40 | ₹ 25 lakhs | 96.38% |

| Aditya Birla Sun Life Insurance Life Shield Plan | 18 – 65 | 10 to 55 | ₹ 25 lakhs | 97.54% |

Let’s deep dive to know more about these term insurance plans in detail:-

1. LIC Tech Term Plan

It is a traditional term plan, providing financial support to the insured’s family in case of his or her untimely demise. This term plan comes with several essential features such as 2 death benefit options- Level Sum Assured and Increasing Sum Assured, policy term between 10-40 years, and maturity age till 80 years.

2. HDFC Click2Protect Plus

This comprehensive term plan offers 3 cover options – Life and CI Rebalance, Life Protect, and Income Plus, from which the policyholder can select as per their requirements. It comes with an option that auto balances death and critical illness benefits with the increase in age and offers whole life cover.

3. Max Life Smart Secure Plus Plan

The Smart Secure Plus Plan by Max Life Insurance gives you the flexibility to customize coverage protection at a reasonable price by offering 2 death benefit covers to choose from. It also provides different payout options to suit the insured’s requirement, which comprises a lump-sum payment, monthly income payment, and partly in a lump sum and partly as monthly income. In addition, it provides terminal illness coverage as well as returns all the premiums paid on policy maturity.

4. SBI Life-eShield

The policy offers four plan options, and you can pick the best one among them, depending on your requirements. It is the best term life insurance policy for your family, and you can apply for the same online without the tedious paperwork. Some of the benefits covered by this policy include renewability, 20 lakhs minimum sum assured, surrendering facility, free-look period, and so on.

5. Tata AIA Maha Raksha Supreme

Maha Raksha Supreme by Tata AIA Life Insurance comes with an in-built accelerator that provides up to 50% sum assured payout on diagnosis of any terminal illness. This plan also offers flexibility to choose from various premium paying terms and riders.

6. ICICI Prudential iProtect Smart Term Plan

This plan is available in 3 options, and you can select the right one after doing complete research. Some of the benefits offered by the policy include death coverage, terminal illness coverage, premium waiver benefit, accidental death benefit, tax benefits, surrender benefits, etc.

7. Bajaj Allianz Smart Protect Goal Term Plan

This plan offers death benefits at affordable premiums and maturity benefits by returning the premiums paid at the policy’s maturity. It also provides financial assistance if diagnosed with any listed critical illnesses in the plan.

8. Canara HSBC OBC iSelect Star Term Plan

This term plan comes with a whole life cover option and offers you the flexibility to enhance your life cover based on your changing lifestyle. It also comes with a return of premium option, spouse coverage, and in-built protection. In addition, it offers multiple death benefit payout option that includes lump sum, monthly income or lump sum plus monthly income.

9. PNB MetLife Mera Term Plan Plus

This term plan offers comprehensive protection at an affordable cost. Moreover, it provides flexibility to opt for protection against terminal illness, critical illness, disability, and death along with various life cover options such as spouse coverage and whole life cover.

10. Kotak e-Term Plan

It is a pure protection plan, and any individual between 18 to 50 years (for limited pay-pay till 60 years) or 65 years (except for limited pay-pay till 60 years) can buy this term plan. The minimum sum assured under this plan is Rs 25 lakhs. The Kotak e-Term plan offers different premium payment modes, including monthly, yearly, half-yearly, and quarterly. In addition, it comes with 3 different pay-put options – immediate payout, level recurring payout, and increasing recurring payout. It also gives the option to add riders for additional protection – Kotak Permanent Disability Benefit Rider and Kotak Critical Illness Plus Benefit Rider.

11. Aditya Birla Sun Life Insurance Life Shield Plan

This term plan by Aditya Birla Sun Life Insurance offers 8 different coverage options which policyholders can choose to meet the specific requirements of their family members. It ensures that the insured’s family members are financially secured in case of the sudden demise of the life assured within the policy tenure. In addition, this plan provides terminal illness benefits and options to increase life coverage by adding riders.

While looking for an ideal term plan you also need to keep in mind certain factors. Here are a few of them.

4 Factors to keep in mind before choosing a term insurance

- Assess your needs: Do you need a term insurance policy or a money-back policy? Before deciding to buy an insurance policy, you need to be clear on the purpose. Assess your current lifestyle and discuss with your partner the future requirements, goals, ambitions, etc.; based on these, you will be easily able to pick the best term insurance policy that aligns with the flow of life.

- Know about the policy: Once you shortlist a policy, spend time reading its features and its benefits instead of relying only on the information given by the insurance agent or your friends. With all the details related to a policy available on the website of the insurance provider itself, it has become easy to collect the necessary information. One can also look for online reviews of the policy for a better idea.

- Choose the riders: Riders are valuable add-ons to extend the coverage of your base policy and have it ready to cover higher risks of your life. Although these riders are offered for an extra cost, it helps you avoid buying multiple policies to cover various risks. Some popular riders are Accidental Death Cover, Accidental Disability Cover, Premium Waiver Cover, Critical Illness Cover, Terminal Illness Cover, etc.

- Pay attention to Claim Settlement Ratio (CSR): The Claim Settlement Ratio of an insurance company must be an important parameter while choosing the best insurance policy. It is the total percentage of claims settled by an insurer in a year out of the total claims received. While a high CSR means the insurance provider clears the claim requests on time, a low CSR denotes the claim settlements are delayed or rejected consistently. Experts recommend taking a policy from an insurance company with high CSR.

Before you proceed to search for the best term life insurance policy in India, we recommend you understand all the insurance policies and their benefits in detail from the brochures available on their website. If required, you may also take the advice of insurance experts or visit iiflinsurance.com and clear your doubts before investing, as this one decision can alter your family’s future in your absence.

FAQs:

Which term insurance is best in India 2021?

There are plenty of term insurance policies available in the market with various features and benefits. However, here is the list of best term plans in India in 2021:

• LIC Tech Term Plan

• HDFC Click 2 Protect Plus

• Max Life Smart Secure Plus Plan

• SBI Life eShield

• Tata AIA Maha Raksha Supreme

• ICICI Prudential iProtect Smart Term Plan

• Bajaj Allianz Smart Protect Goal Term Plan

• Canara HSBC OBC iSelect Star Term Plan

• PNB MetLife Mera Term Plan Plus

• Kotak eTerm Plan

• Aditya Birla Sun Life Insurance Life Shield Plan

Which company is best for buy a term plan in India?

All insurance companies have their pros and cons; however, you should select the company to buy a term plan in India based on their claim settlement ratio, solvency ratio, and reviews.

Claim settlement ratio (CSR) is the number of claims settled in a year by an insurance company. Higher the CSR more reliable is the insurer.

The solvency ratio refers to the measure of risk that an insurer faces, which it cannot absorb. Insurers with a higher solvency ratio are more financially stable and hence, more equipped to pay the insurance claims.

Reviews are genuine testimonials or reviews by the customers, determining the insurer's reputation among the buyers.

How do I choose the best insurance plan?

While choosing the best insurance plan, you need to consider the following factors:

• Evaluate your needs first

• Thoroughly go through the policy features, terms, and conditions

• Look for riders available with the policy

• Enquire about the insurer's Claim Settlement Ratio

What things should you consider while buying a new term plan in 2021?

To buy a new term plan in 2021, you should consider the following factors:

• Your life stage

• Your income

• Number of dependents

• Any debts and liabilities

• The cover amount you will require to fulfill your family's requirements.

What is the best age for a term insurance policy?

The ideal age to buy term insurance is at the earliest in your life stage to garner maximum benefits. However, you can purchase a term plan as early as 18 years.

How many term insurance policies can I buy in India?

You can buy more than one term insurance plan to fulfill your requirements. You can also have more than one nominee in your insurance policy.

What are the different types of term insurance plans available in India in 2021?

The different types of term insurance plans available in India in 2021 are:

• Level term plans

• Term Return of Premium Plans (TROP)

• Increasing term plan

• Decreasing term plans

• Convertible term plans

• Group Term plans

Which insurance company has the best claim settlement ratio?

According to IRDA Life Insurance Claim Settlement Ratio 2021, Max Life Insurance has the best claim settlement ratio of 99.00%, HDFC Life 99.07%, and Tata AIA 99.06%.

What are the documents required to buy a term insurance plan online?

Below are the standard documents that are needed to buy a term insurance plan online

• Duly filled Proposal form

• Address Proof - Driving License, Aadhaar Card, Passport, Voter ID, Ration card

• Identity Proof – Aadhaar Card, Passport, PAN card, Voter ID

• Income Proof - Salary slips, latest for 16, Bank statement, last 3 years Income tax return.

• Age Proof – Passport, PAN card, Birth certificate.

• Photographs

What are the top benefits of buying a term plan?

The primary benefits of buying a term insurance plan are:

• High sum assured at affordable premium amount

• Simple and easy to understand.

• Multiple options for paying death benefit amount

• Additional rider benefits

• Income Tax benefits

• Critical illness and accidental death benefit coverage

• Return of Premium option

Which term plan is best in 2021?

Here is the list of best term plans in India 2021

• LIC Tech Term Plan

• HDFC Click2Protect Plus

• Max Life Smart Secure Plus Plan

• SBI Life-eShield

• Tata AIA Maha Raksha Supreme

• ICICI Prudential iProtect Smart Term Plan

• Bajaj Allianz Smart Protect Goal Term Plan

• Canara HSBC OBC iSelect Star Term Plan

• PNB MetLife Mera Term Plan Plus

• Kotak e-Term plan

• Aditya Birla Sun Life Insurance Life Shield Plan

How do I choose the best term policy in 2021?

You should consider these pointers to choose the best term policy in 2021

• Consider your life stage

• Consider coverage amount based on the dependent family member

• Consider any liabilities or outstanding loans

• Look for insurers with a high claim settlement ratio

• Know the riders available with the term plan

Which term plan is best for a child in 2021?

The best term plan for a child in 2021 includes:

• HDFC Life YoungStar Super Premium Plan

• ICICI Smart Life Plan

• Bajaj Allianz Young Assure Plan

• LIC New Children’s Money Back Plan

• Max Life Future Genius Education Plans

How much cover should I take in a term policy?

Financial experts often recommend that the term insurance cover ideally should be 15 to 20 times your annual income. So, for example, if your annual income is Rs 10 lakhs, your cover amount should be a minimum of Rs 1.5 crore.

How can I choose the best term plan for my parents in 2021?

The ideal way to choose the best term plan for your parent is by considering the below pointers while buying the plan:

• Coverage amount- the higher, the better

• Flexibility- option to increase the sum assured if it gets exhausted

• Co-Payments clause

• Maximum Age to Renew

• Pre-existing Illnesses and Waiting Periods

• Simple and hassle-free Claim Process

• Inclusions and exclusions in the policy

• Number of Network Hospitals

How important is a term insurance plan?

A term insurance plan is a significant financial option for any individual. It acts as a financial cushion during uncertain times and helps the policyholder’s family member lead a comfortable life without any financial stress.