5 Top 1 Crore Term Insurance Plans in India for 2022 – A Complete Guide

1 crore term insurance plan! What is it all about? Is a 1 crore term plan affordable to everyone? Or does it have a higher premium? Will the amount of 1 crore be sufficient for my family?

Ramesh does not only have these limited questions, but an array of questions keeps mounting in his mind since the moment he heard about the 1 crore term plan.

Like anyone else, Ramesh also wants a high sum assured term plan. But it is pretty much clear that a high sum assured term plan would have a high premium amount to pay. Therefore, affordability becomes a big question. Of course, people of high-income groups and in business can opt for a high premium payable term plan, but how about people like Ramesh with an average income, who also has the significant responsibility to run his family with his limited income?

Here is the answer to all the questions!

What is a 1 Crore Term Plan?

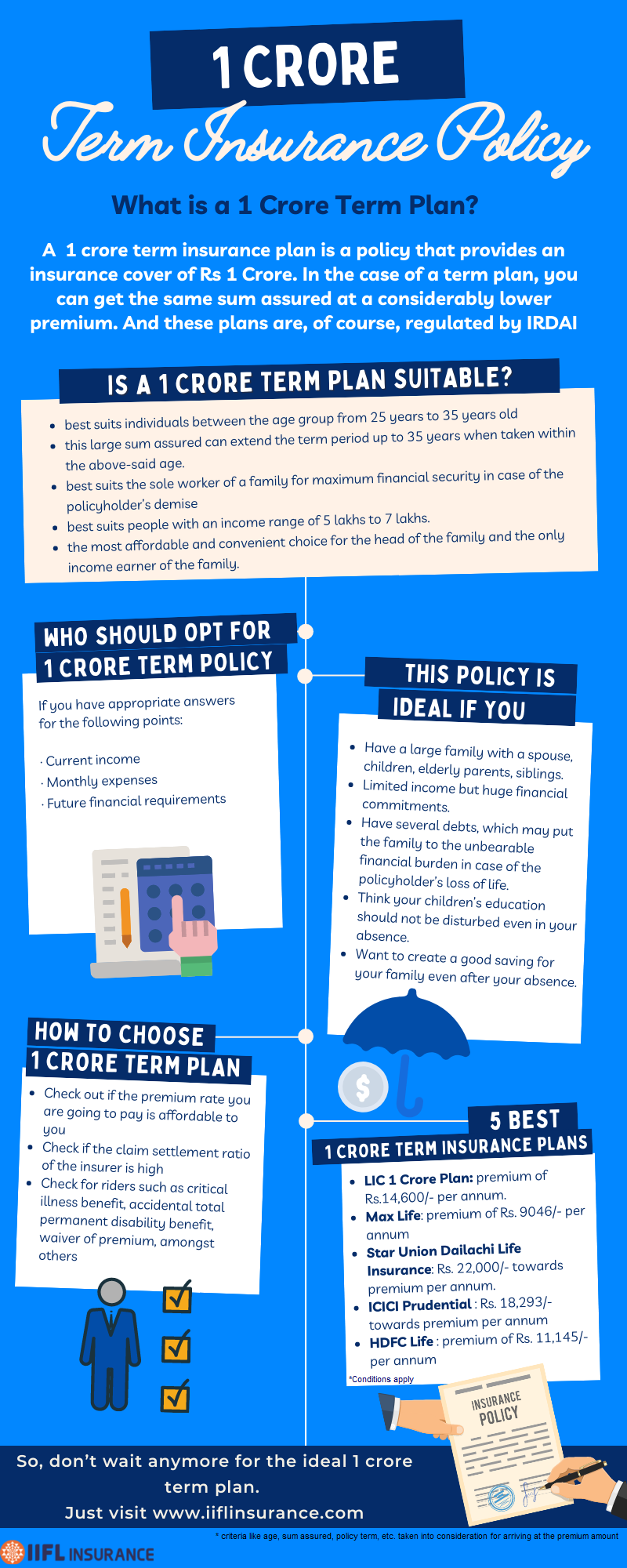

A 1 crore term insurance plan is a policy that provides an insurance cover of Rs 1 Crore. When other types of life insurance policies offer a high sum assured of 1 crore, they demand a high premium. However, in the case of a term plan, you can get the same sum assured at a considerably lower premium. These plans are, of course, regulated by IRDAI and available both online and offline. Let’s understand the 1 crore term plan in detail.

Is a 1 crore term plan suitable?

Here is a brief for you about this high cover term plan:

- This term plan best suits individuals between the age group from 25 years to 35 years old.

- This large sum assured can extend the term period up to 35 years when taken within the above-said age.

- This plan best suits the sole worker of a family. Therefore, this can help the family get maximum financial security in case of the policyholder’s demise.

- This plan best suits people with an income range of 5 lakhs to 7 lakhs.

- This is the most affordable and convenient choice for the head of the family and the only income earner of the family.

5 Best 1 Crore Term Insurance Plans in India for 2022

-

- LIC 1 Crore Plan: The name of the plan is the e-Term plan, which is the basic plan. LIC has a claim settlement ratio of 98%, and a sum assured of 1 crore comes with a premium of Rs.14,600/- per annum.

- Max Life: This is an online basic term plan and comes with an annual premium of Rs. 9046/- per annum. Max has a claim settlement ratio of 95.5%.

- Star Union Dailachi Life Insurance: The name of the plan is Premier Protection Plan. The company has a claim settlement ratio of 94% and you need to pay Rs. 22,000-/ towards premium per annum.

- ICICI Prudential: ICICI has a claim settlement ratio of 93.8%. ICICI Prudential iCare II Term Plan comes at Rs. 18,293 towards premium per annum.

- HDFC Life: HDFC Click 2 Protect Plus Term Plan comes with an annual premium of Rs. 11,145. HDFC has a 90.5% claim settlement ratio.

After diving deeper into the details of the 1 crore term plan, now let’s understand its importance and why you should opt for it.

Who should opt for a 1 crore term policy?

This is the most affordable term plan product available in the insurance market. By buying this product right at the early stage of your life, you can secure your family even at lower premiums when compared to other types of life insurance policies. However, unlike today, the financial need for a family will keep growing over the years with the increase in the cost of living and inflation rate. Therefore, instead of taking term insurance according to your current financial requirements, it is always better to buy your term plan with a future focus.

The term insurance plan for 1 crore is suitable for you if you have an appropriate answer for the following points:

- Current income

- Monthly expenses

- Future financial requirements

Once you are clear about these points, you can decide if you want a 1 crore policy or not.

This policy is ideal for those with:

- A large family with a spouse, children, elderly parents, siblings.

- Limited income but huge financial commitments.

- Have several debts, which may put the family to the unbearable financial burden in case of the policyholder’s loss.

- When you think your children’s education should not be disturbed even in your absence.

- When you want to create a good savings for your family even after your absence.

There are many insurance companies like HDFC, ICICI, LIC, SBI, and many others providing the 1 Crore term plan. Although all the plans sound to give similar benefits, trying to make a comparison and identifying its features and terms is crucial to select the right one for you. In this case, here are a few points to help you.

How to choose the 1 Crore Term Plan in India?

- Check out if the premium rate you are going to pay is affordable to you, and whether you can manage regular payment of the premiums without any interruption.

- Check if the claim settlement ratio of the insurer is high because this may vary with different insurance companies. The higher the claim settlement ratio, the better the claim service will be provided by the insurance provider.

- Do check the additional features that the 1 crore plan offers like riders such as critical illness benefit, accidental total permanent disability benefit, waiver of premium, amongst others.

There are also many other insurance companies offering a 1 crore term plan. However, putting some effort into comparing and identifying the right one is crucial. Along with Ramesh, now you would have got a better idea about the 1 crore term plan. So, don’t wait to start your search for the ideal 1 crore term plan by visiting iiflinsurance.com. You can fill in your details and get quotes from different insurers in India.

1 Crore Term Insurance Plans FAQs:

What is 1cr term insurance?

1 crore term insurance plan refers to the term plan wherein the sum insured or the death benefit amount is Rs 1 crore. Therefore, in case of the untimely demise of the policyholder within the policy term, the nominee or the beneficiary of the policy will receive Rs 1 crore as the payout benefit amount.

Who should opt for 1 Crore Term Plan?

A 1 crore term plan is ideal for those who have:

• large family with spouse, children, elderly parents, siblings

• limited income but huge financial commitments.

• several debts and liabilities which might put the insured’s family member under financial burden in absence of the insured

• to ensure a secured financial future of their children in their absence

What are the top benefits of buying 1 crore term insurance policy?

The top benefits of buying 1 crore term insurance plan are:

• High coverage at affordable premiums

• Secures family loans, liabilities and debts

• If bought early, can help in saving more

• Complete protection for the entire family

• Tax benefits up to Rs 46,800

Which is the best 1 crore term plan you should buy in 2021?

The best 1 crore term plan in 2021 that you can buy are:

• Bajaj Allianz iSecure Term Assurance Plan

• HDFC Life Click2 Protect Plus Plan

• Aegon Life i-Term Insurance Plan

• LIC Tech Term Plan

• ICICI Prudential iCare II Term Plan

Which insurance company provides the best 1 crore term insurance policy in India?

There are various insurance company that offers 1 crore term insurance policy in India which includes LIC, HDFC, ICICI, Max Life Insurance, SBI, Aegon Life Insurance amongst other. However, it depends on the requirement of the policyholder to decide which insurer’s term plan suits the best. therefore, one should always compare various term plan available in the market.

What is the eligibility for buying 1 crore term insurance plan in India?

If a person age between 30 to 35 years, and can earn for a longer time while being the sole earner of the family, then that person will be eligible for 1 crore life insurance policy.

How can I compare the best 1 crore term insurance plan?

To compare the best 1 crore term insurance plan, you can visit iiflinsurance.com and compare the various 1 crore term insurance plans available in the market through its term insurance calculator. It will give you quotes from various insurers based on your eligibility.