What is Engine Protection Cover?

When you buy a motor insurance plan, whether a bike insurance plan or a car insurance plan, the engine of the vehicle is not covered under the insurance coverage. This is why you need to buy extra car engine insurance, in the form of a rider, to have your engine covered. But how effective is this cover and why should you buy it? Take a look at this article and get answers to all your questions.

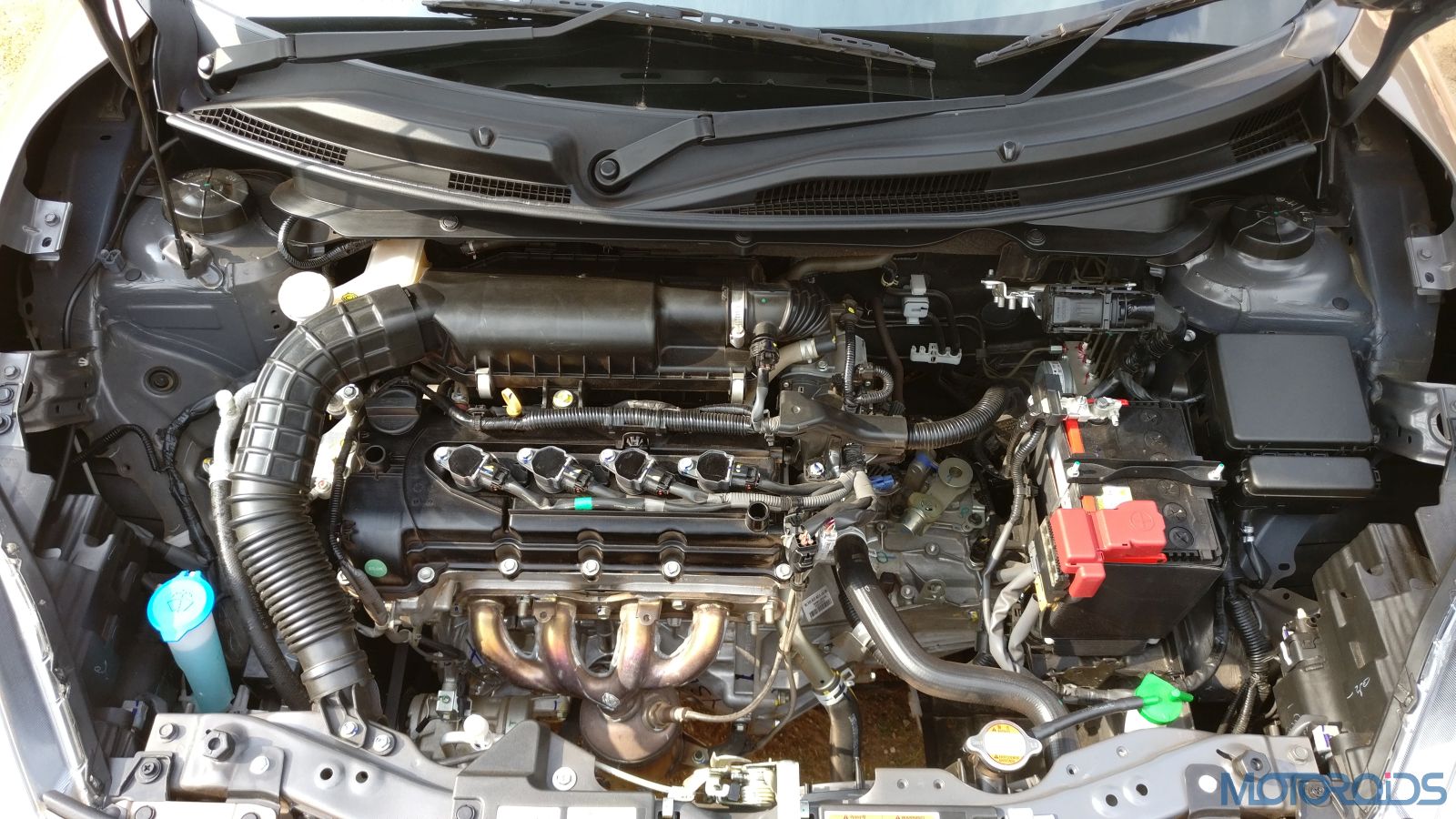

Engine Protection Cover

As you saw, the regular motor insurance plans do not cover engine damage liabilities. Since the engine forms the backbone of the vehicle, you need to ensure it is covered at all times as it should be able to perform well and keep your vehicle in good condition as well. Here are some more reasons why you need an engine protection cover:

- Covers engine damages

The car engine insurance add-on cover offers protection to the most expensive and important component of your vehicle – the engine. As you know, your car will be of little or no use if the engine doesn’t function well. This is why you need to buy an engine protection rider to keep the engine in good condition at all times.

- Keeps your vehicle in a good state

As stated, the engine is very important. It keeps the car running and in a usable state. This is why you need to keep the engine in the best condition. If your engine performs well, the entire vehicle will benefit from it and you will end up with lower maintenance problems which will prove to be highly beneficial for you.

- Financial protection

Since the engine of the car is the most important component of the vehicle, it also is considered to be the most expensive part. Repairing the engine can be an expensive task. This is another reason why you need an engine protection cover in car insurance. With this cover in place, you can afford the expensive repairs without having to spend your own money on it.

These are some of the main reasons why you need to invest in engine protection cover in car insurance. You must however remember that since it is a rider, the engine protection cover rider will cost you extra money. You have to pay a higher premium when this rider is attached to your car insurance policy. However, it is an important cover and does not let the price factor hold you back from purchasing the car engine insurance add-on coverage.

Benefits of an Engine Protection Cover

- Covers the expensive engine

The engine and its components are costly. If any part of the engine, or the entire engine, is damaged, you will need to spend a lot of money to get it repaired. Having a car engine insurance add-on cover at such a time proves to be highly beneficial as you can get the engine repaired without having to think twice about the expenses.

- Protects against natural calamities

Natural calamities, such as floods and storms are the main reason why the engine of the car gets damaged. People who live in flood-prone areas have to park their cars in places where water flooding is common. As a result, the water seeps into the engine and damages it. Opting for engine protection cover in car insurance proves to be very handy in such situations.

- Protects new cars

The engine of a new car is just as expensive as the car! With age and depreciation, the value of the engine falls too, but a new engine is highly valuable. If you have recently bought a new and expensive car, you should definitely get an engine protection cover in car insurance too. Your vehicle’s engine will remain protected.

- Increases longevity of the car

The engine needs to be in a good performing state to ensure the overall health and wellness of the vehicle is maintained. If you keep the car running with a faulty or broken engine, the entire car will get affected. All the other components of the car will start getting hampered and this will decrease the longevity of the vehicle as a whole. This is why you need to get car engine insurance with the help of which you can keep the engine of the best possible quality every single day.

- Wide range of covers

There is a long list of covers available under the engine protection rider in car insurance. From physical damages to the engine, to oil leaks to repairs to the gearbox, you can expect to get compensated for a majority of the problems faced. This is highly beneficial as it helps you to keep all aspects of the car’s engine safe and healthy which in turn ensures the car runs smoothly on the road.

- Easily available

The next, and perhaps one of the handiest, benefits you get here is that the engine protection rider is very easily available. You can buy the rider along with the car insurance plan when you are buying insurance online. Every leading car insurance company in India has these riders on offer along with comprehensive motor insurance plans. Compare the plans, review the results and then get the best coverage at the best possible rate.

- Inexpensive

The engine protection rider in car insurance is quite inexpensive. This helps you to choose the rider as a part of your overall motor insurance coverage. As stated above, it is a rider and you will have to pay an extra premium amount for it. However, even with the payment of the added premium, the purchase proves to be cost-effective as the coverage available is quite larger and wholesome under this rider.

As you can see, the car engine insurance rider is indeed one of the best add-on covers available in motor insurance. As a result, it makes a lot of sense for you to purchase this add-on cover when you buy a car insurance plan. The rider can be bought for a brand new car or a pre-used car.

Inclusions and exclusions of Engine Protection

| INCLUSIONS | EXCLUSIONS |

| Damage due to oil leakage within the engine | Damage caused by forcefully trying to start an engine that has water seepage |

| Water damage to the engine | Consequential damage caused if the car is driven following a mishap |

| Components of the engine are protected including the rods, pistons and gearbox | Engine damage due to accident caused by drunk driving |

| Combustibles are covered such as the lubricants, nuts and bolts in the engine | No coverage is available if the vehicle is older than five years |

| Damage to the hydrostatic lock | If two claims are made in a year, all further claims will be rejected |

Go over the list of inclusions and exclusions available in the engine protection cover in car insurance and you will be sure of the benefits available to you. It will also help you to make an effective claim that you can get approved in a short period of time.

Conclusion

Buying a good car insurance plan is essential and the law in India also mandates it. However, getting the plan alone may not be enough for you. You will need to customize it with the help of some car insurance riders. The engine protection cover is one of the best and the most popular car insurance riders that you can consider buying. As you saw from all the points mentioned above, it offers many benefits and helps to keep your vehicle secure in a more wholesome manner. So go ahead and get this rider and increase the scope of your car insurance cover.