Safeguard Your Parents With Health Insurance and Medical Insurance

15%, that’s the rate of healthcare inflation in India; more than double the rate of overall inflation. Experts point to the unregulated healthcare system in the country as the key reason for such a high inflation rate. You just need to walk into any hospital to understand this.

Considering the steep rise in medical and hospitalization costs, year after year, it is advisable for every member in your family to be insured adequately, especially senior members.

Have you been putting off the idea of buying health insurance for your parents for some reason? Are you mulling over which health plan to buy for your parents? Wondering when is the right time to buy insurance for them? It’s today!

The golden rule is that the sooner you buy insurance for your parents, the better it is. As age advances, premium increases. Moreover, with age, senior members are more prone to health issues, which could make buying an insurance difficult as well as result in lower sum insured or higher premium. Even the freeze period could be longer.

Buy the right insurance plan, at the right time, of the right amount. So if you’ve been delaying this decision for any reason, here are the reasons you shouldn’t.

Reasons to buy health insurance for parents

Financial support against healthcare expenses

Health insurance for parents is one of the best financial supports that can help your parents and you to deal with the health risks associated with ageing. As our parents age, their healthcare needs increase significantly.

The reasons: seasonal illnesses due to weaker immunity, higher chances of chronic and critical illnesses and lifestyle and mental conditions. When these health problems become emergencies or need advanced medical care, health insurance can be the saviour that provides financial support.

Reduces your parents stress and worry

With hectic work life, and increasing family needs, one can often face increased mental stress. Not just us, even our parents experience increased stress levels with age. Their worries mostly surround their children, grandchildren, their property and assets, and their depleting retirement savings.

In such a situation, when parents have the security of health insurance, some of their worries can be reduced. Their fear of financial burden due to health conditions, and the worry of their children having to spend from their savings can be reduced significantly.

What is more, due to the age factor, the premium for health insurance for parents might be higher. A higher premium, in most cases, would mean adequate sum insured, and wide coverage to protect all kinds of healthcare needs.

If parents have an adequate sum insured, they do not have to worry about medical expenses. Similarly, you, their financial supporters, too, do not have to worry about sudden medical expenses. Moreover, you can ensure the best medical treatments for your parents if you have health insurance for them.

Aged parents are more prone to illnesses

Studies show that the prevalence of health conditions such as depression, heart ailments and hypertension in older people are higher in India compared to other countries. The aged living in urban areas are more prone to certain types of ailments such as those that arise from lifestyle, pollution and more. Hence those living in cities must consider health insurance for the elderly, a necessity.

Additional tax savings

Additional tax savings from health insurance for parents

Did you know you could legally reduce your tax amount simply by buying health insurance plans for your parents and your family members? Here are the details you must know about how much tax you could save under Section 80D of the Income Tax Act.

- If your parents are below the age of 60 years, you can get an additional tax deduction of Rs 25000.

- If your parents are above the age of 60 years, you can get an additional tax deduction of Rs 50000.

- The above tax deduction benefits are over and above the tax benefits, you would get on your own health insurance cover. That means: your exempt income can be as high as Rs.100,000 on account of health insurance and your actual tax benefit will depend on the income bracket you are in.

Less mental stress

With a hectic work life, and increasing family needs, you often face increased mental stress. Not just we, our parents also experience increased stress levels with age. Their worries mostly include their children, grandchildren, their property and assets and their depleting retirement savings.

In such a situation, when parents have the security of health insurance, some of their worries can be lessened. The fear of financial burden due to health conditions, and the worry of their children having to spend from their savings can be reduced significantly.

What is more; due to the age factor, health insurance for parents might have a higher premium, but it is reasonable. A higher premium, in most cases, would mean adequate sum insured, and sufficient wide coverage to protect against all kinds of healthcare needs.

If parents have an adequate sum insured, they do not have to worry about medical expenses. Similarly, you, their financial supporters, too, do not have to worry about sudden medical expenses. Moreover, you can ensure the best medical treatments for your parents if you have health insurance for them.

Elderly people are more prone to illnesses

Studies show that the prevalence of health conditions such as depression, heart ailments and hypertension in older people are higher in India compared to other countries. The aged living in urban areas are more prone to certain types of ailments such as those arising from lifestyle, pollution etc. Hence those living in cities must consider health insurance for the elderly, a necessity.

Key points to consider when choosing an insurance plan for parents

- The entry and exit age

- Maximum age for renewal of the policy

- Exclusions

- Co-payment

- Waiting period

- Pre-policy health check-up

- Critical illness coverage

Kinds of health insurance plans for parents

You can safeguard your parents with health insurance or medical insurance plans. Both are different.

Mediclaim insurance: it offers limited types of coverage such as hospitalization, accidents and pre-existing diseases for a limited period of time. Typically the sum insured in Mediclaim is limited to Rs 5 lakh. It doesn’t provide coverage for critical illnesses, nor does it provide flexibility to make changes or adjustments.

Health insurance: it offers comprehensive coverage related to healthcare needs such as hospitalization, pre and post hospitalization, ambulance and room rent, and some plans even offer income loss due to accidents and illnesses.

Now let’s look at the different kinds of health insurance plans that are suitable for parents.

Senior citizen health insurance plans

A number of health insurance companies have special plans for senior citizens – age 65 years and above – that are created keeping in mind the needs of senior citizens. Most of these plans offer the following features:

- Pre and post hospitalization coverage

- Medical bills and hospital room rent

- Cashless hospitalization

- Ambulance cost coverage

- Pre-existing diseases

- Free health check-up

- Alternate AYUSH treatments

Some of the best plans for parents currently offered by insurers

| Health Insurance Plan | Age | Key Features |

| Bajaj Allianz Silver Health Plan | 46 to 70 years |

|

| Bharti AXA Senior Citizen Health Insurance | 65 years |

|

| Aditya Birla Activ Care Senior Citizen Health Insurance | 55 to 80 years |

|

| HDFC Ergo Health Insurance for Senior Citizens | No age limit |

|

Critical illness health insurance plans

Critical illness health insurance plans offer coverage for critical illnesses such as cancer, heart attack, kidney failure, organ transplant, paralysis, among others. Critical illness plans function in a different manner. Here, the insured receives the full sum insured upon the diagnosis and treatment of the critical illness. Here the payout is fixed and not according to the medical expenses. You must keep in mind that a critical illness plan does not offer coverage that health insurance or mediclaim plans offer. Hence, you might want to invest in both, a health insurance and a separate critical illness plan for your parents.

Aditya Birla Critical Illness Health Insurance Policy: This plan offers variants that cover 20, 50 or 64critical illnesses according to the plan chosen.

- Sum insured up to 1 crore

- Lump sum payout on detection

- Provides option for second e-opinion

MaxBupa CritiCare: A plan that offers coverage against 20 critical illness, here are its key features:

- Sum insured up to 3 crore

- 30-minute cashless claim process

- Lifetime renewability

Specific illness plans

Some health insurers offer plans for dedicated illnesses. These plans are designed to cover treatment expenses for specific diseases only. For e.g., if there is a family history of diabetes, one could go for a health insurance plan that is specially designed to cover diabetes. Some insurance policies for diabetic patients are: HDFC Ergo (Energy Diabetes Insurance), Star Health (Diabetes Safe Insurance Policy), and Religare Health Insurance (Diabetes Health Insurance), among others. Among other dedicated illnesses plans, insurers also offer plans for cardiac and heart, for e.g. Religare Health (Care Heart) and Star Health Insurance (Star Cardiac).

Family floater plans with parents included

Family floater plans are those that offer one policy for the entire family. Some family floater plans offer the option of including parents, grandparents and senior citizens. Under family floater plans, insurers offer one sum insured for all the members. The sum insured can be claimed by any of the members in full or as remaining after claims made.

However, whether or not to include your parents in your family floater plan is a critical decision. Usually, insurers would consider the age of the oldest member in a plan to calculate the premium. Hence, if you include your parents in the family plan, the premium amount would increase considerably.

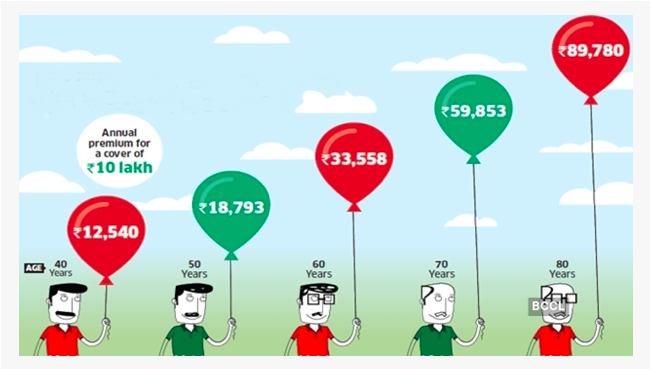

Let’s take for example, you are 40 years old. And your parents are 70 years old. The illustration below shows the approximate difference in the amount of premium.

Source: Economic Times

Source: Economic Times

Star Health Family Health Optima: this super saver family health insurance plan is available for the age group of 18 years to 65 years. It includes members- spouse, dependent children (16 days to 25 years), and parents. Its key features are:

- Sum insured up to Rs 25 lakh

- Coverage for newborn baby

- Air ambulance cover up to 10% of the basic sum insured

- Bonus and additional sum insured

In a nutshell

There are loads of health insurance plans in the market that are specially designed for your parents’ healthcare needs. You just need to find the right one for your parents. Your parents’ medical emergency can cause serious financial set-back to your finances. That is only if you do not have health insurance for your parents. Get started by choosing the right plan for your parents before it’s too late.

FAQs: Health Insurance for Parents

Do my parents have to go through medical tests when buying health insurance?

Whether or not your parents will have to have a medical test while they are purchasing health insurance depends on the plan that they have chosen. Pre-policy health check-up is mandatory in certain plans. It is best to ask your insurance agent or the insurance company once you choose the plan.

Can I include my senior parents in my family floater plan?

Typically, health insurance plans have a cap on the age of senior members to be included in a family floater plan. The reason being, elderly people have more healthcare needs compared to younger people. Another reason is that health insurers would consider the age of the oldest member to calculate the premium. Senior members in a family floater plan would mean higher premiums, as well as higher sum insured because their medical needs are higher.

What is covered under AYUSH for senior citizen health insurance?

Alternative treatments such as Ayurveda, Unani, Sidha, and Homeopathy are covered only if the treatments are done at certified AYUSH centers.