Best Postal Life Insurance (PLI) Scheme Plans for Government Employees

Uncertainty is an unavoidable part of life that can happen at any time. Therefore, one should consider taking a life insurance policy for the family’s secured future. This is because it will help to reduce the burden during uncertain times.

Let’s take an example, Mahesh is an engineer by profession who works in a government office, and he has no financial commitments apart from his own needs. He knows about the importance of life insurance and decided to buy a new policy. However, Mahesh has no idea about which one to choose for his family after marriage. Now, he decided to purchase a postal life insurance scheme because it will benefit his family in case of sudden death.

Moreover, there is no need for his spouse to depend on others when it comes to children’s education and other things.

Although there are several insurance plans available in the markets, not all of them are the same. The postal life insurance is the best one for government employees to experience peace of mind from uncertainty and other problems.

What is a Postal Life Insurance Scheme?

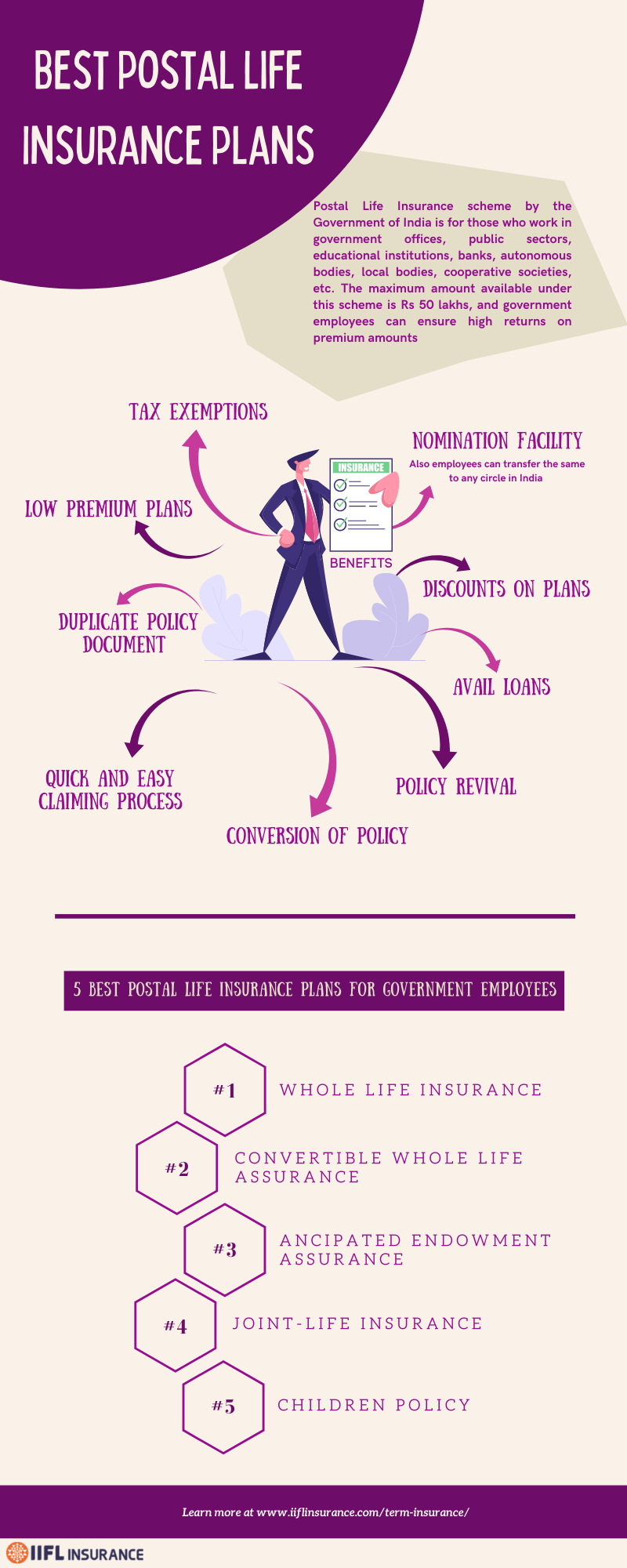

Postal Life Insurance (PLI) is a scheme by the Government of India for those who work in government offices, public sectors, educational institutions, banks, autonomous bodies, local bodies, cooperative societies, etc. The maximum amount available under this scheme is Rs 50 lakhs, and government employees can ensure high returns on premium amounts.

There are different types of Postal Life Insurance Scheme available. However, the best Postal Life Insurance (PLI) Plans for Government employees include:

6 Best Postal Life Insurance (PLI) Plans for Government Employees 2022

- Whole Life Assurance (Suraksha)

- Endowment Assurance (Santosh)

- Convertible Whole Life Assurance (Suvidha)

- Anticipated Endowment Assurance (Sumangal)

- Joint-Life Insurance (Yugal Suraksha)

- Children Policy (Bal Jeevan Bima)

1. Whole Life Insurance

The policy is ideal for government employees. The minimum age is 19 years, and the maximum age is 55 years to enter into this plan. It offers an assured sum with accrued bonuses to a policyholder. Moreover, a policyholder can even convert a plan to an endowment policy after the completion of a year. On the other hand, medical examinations are mandatory while buying this plan. The policyholders can apply for loans after four years of completion. However, they won’t get any bonuses after taking a loan. The minimum sum assured in this plan is Rs. 20,000, and policyholders should check out the details from different sources when they want to buy a new one.

2. Endowment Assurance

Under this plan the policyholder gets a guaranteed sum assure and accrued bonus until the person attains the pre-determined maturity age i.e 35, 40, 45, 50, 55, 58 & 60 years of age. In case of the insured’s demise, the nominee gets the complete sum assured with the accrued bonus. The minimum entry age for this plan is 19 years and the maximum is 55 years. The minimum sum assured is Rs 20,000 and maximum is Rs 50 lakhs under this scheme. Loan facility is available in the Endowment Assurance plan after 3 years and surrender benefit also is available after 3 years.

3. Convertible Whole Life Assurance

This policy also offers an assured sum with accrued bonuses to a policyholder. Furthermore, he/she can convert the same into an endowment policy after 5 policy years. One can surrender the policy after three years of completion. An insurance company will treat the policy as whole life assurance when it is not converted. It is wise for government employees to read terms and conditions in detail before choosing this plan. This, in turn, provides ways to make the right decision while investing money.

4. Anticipated Endowment Assurance

Anticipated endowment assurance is a money-back policy meant for those who want to get periodic returns. It offers coverage for 15 years and 20 years, enabling a policyholder to earn some good profit. However, a policyholder should know the benefits covered after choosing a term plan. The 15-year policy lets policyholders ensure a 40% accrued bonus on maturity with 20% each on completion of six years, nine years, and twelve years. In the same way, a 20-year term plan offers the same bonus with 20% each on completion of eight years, twelve years, and sixteen years.

5. Joint-Life Insurance

The joint-life insurance offers coverage for both the spouse and can include family members as well. Any of the partners who is a government employee can avail of this plan. The minimum policy term is for five years, and the maximum is of 20 years. The minimum entry age for this plan is 21 years, and the maximum is 45 years. A policyholder will get a proportionate bonus on the reduced sum assured after surrendering the plan. On the other hand, it is not possible to avail bonuses when a person surrenders a policy before 5 years. Hence, one should know the features and postal life insurance plan details while buying a policy.

6. Children Policy

The policy offers coverage to children of policyholders with a sum assured of Rs. Three lakhs. A maximum of two children is eligible for this plan whose age range is between 5-20. At the same time, a policyholder shouldn’t attain the age of 45 years and be responsible for the payments. Loans are not allowed under this policy and don’t need any medical exams. Apart from that, no surrender policy is available after choosing this plan.

What is the Interest Rate on loans under Postal Life Insurance Scheme?

The interest on loan availed against the Postal Life Insurance (PLI) policy is 10% per annum. This is calculated based on a six-month period.

9 Benefits of investing in Postal Life Insurance (PLI) Scheme

- Tax exemptions

- Low premium rates when compared to others

- Nomination facility and employees can transfer the same to any circle in India.

- Quick and easy claiming process

- Discounts on plans that will save money

- Enables policyholders to get loans and other financial gains

- Policy revival

- Duplicate policy document

- Conversion of policy

Overall, the postal life insurance for government employees is a low premium plan that offers various benefits to the policyholders. However, employees should make sure that they select the best plan that caters to their needs and fits their budget.

PLI for Government Employees FAQs:

What do you mean by Postal Life Insurance (PLI)?

Postal Life Insurance is similar to other insurance plans offers by various insurance companies. It is a scheme by the Government of India for people working in public sectors, government offices, banks, education institutions, autonomous bodies, etc. The maximum sum assured under Postal Life Insurance is Rs 50 lakhs, which is paid to the nominee upon the insured’s death, ensuring high premiums return.

Is Postal Life Insurance better than LIC?

Postal Life Insurance (PLI) offers a low premium as compared to LIC. Also, the bonus provided by PLI is more which is in the range of 7% or more, whereas LIC offers a bonus rate of about 4% to 5%.

Which policy is best in Postal Life Insurance (PLI)?

Postal Life Insurance includes 6 different plans with various features and benefits.

• Whole Life Assurance (Suraksha)Endowment Assurance (Santosh)

• Convertible Whole Life Assurance (Suvidha)

• Anticipated Endowment Assurance (Sumangal)

• Joint Life Assurance (Yugal Suraksha)

• Children Policy (Bal Jeevan Bima)

You should carefully go through each one of these and opt for the best one based on your requirements.

What is the interest rate in Postal Life Insurance Scheme?

The interest rate under Postal Life Insurance Scheme is 10% per annum which is calculated on a 6 months period.

Is postal life insurance maturity tax-free?

According to the Income Tax Act, the sum assured plus bonus paid on the maturity or while surrendering the policy or on the insured’s death are exempt from tax, according to Section 10 (10D) of the Income Tax Act.

How to check the status of a post-office life insurance policy?

The Postal Life Insurance Policy status can be checked by logging on to the official website of Indian Post - www.indiapost.gov.in, with their new or old registered email id. After login with the credentials, one needs to click on the submit to check the policy status.

What is the maximum Postal Life Insurance policy limit for a person?

The minimum sum assured under the Postal Life Insurance policy is Rs 20,000, and the maximum is Rs 50 lakhs for all the plans except the children's policy. For Children Policy, the maximum sum assured is Rs 3 lakh.