A detailed guide on reasons and types of short-term investment plans for NRIs

Are you working in a foreign country and still want to make some investments in India? Then, you have ample investment options to go with.

Harish is a young 30 years old man working in the UK. He works with a renowned software development company and is in a good position. Although he has his career now in the UK, as a non-resident of India, he still feels that he should make some investment in India, where he was born and brought up. To achieve this, Harish is now in search of some best short-term investments.

If you are also looking for a similar investment type in India, you will undoubtedly get all the best options here. Continue reading!

Who is an NRI?

Before we begin, let us first try to know who an NRI is? NRI – Non-resident Indian. An NRI is the one who lives abroad or has spent less than 183 days of the financial year or tax year in India. This tax year will stretch from April 1st to March 31st in the succeeding year, which means that one has to be outside of India for more than 182 days from April 1st of last year to March 31st of this year.

Most of the NRIs will make a good source of income, and they feel they should invest in India. For these reasons, they are primarily in search of some long or short-term investment plan for NRIs.

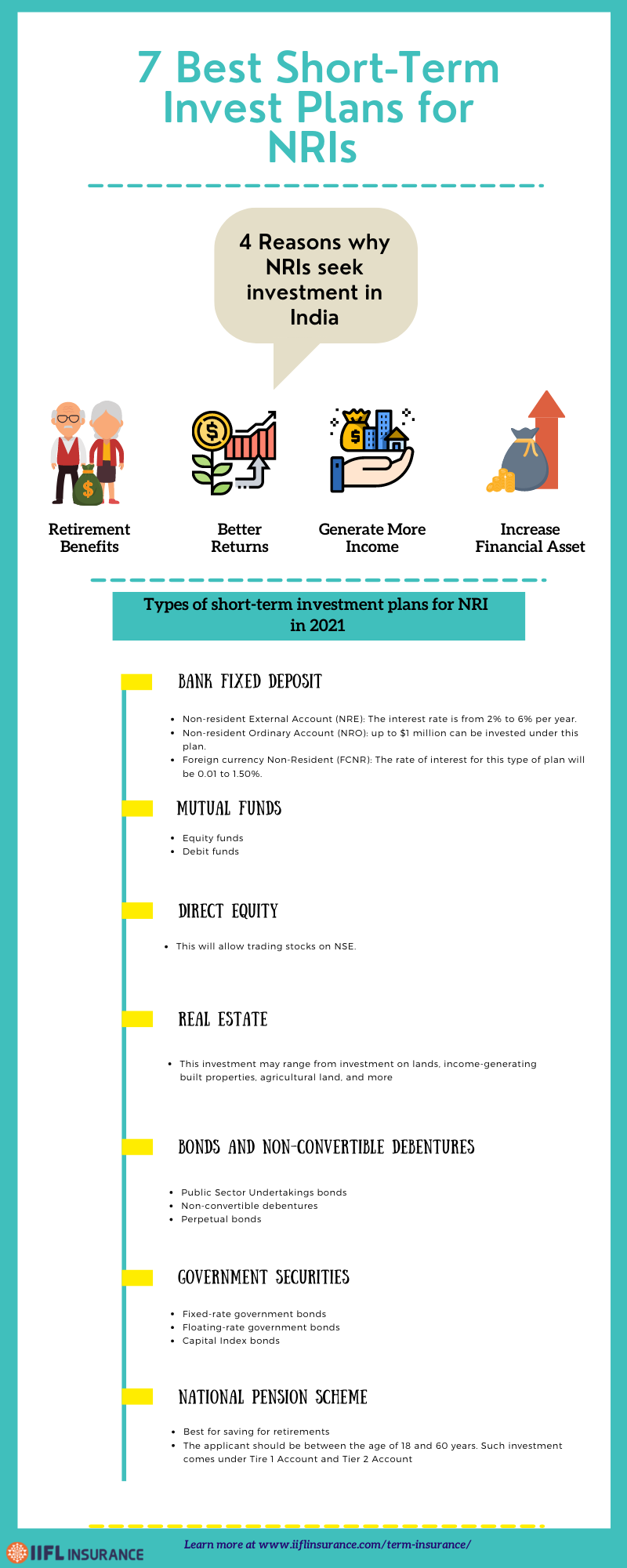

4 Reasons why NRIs seek investment in India

- Retirement: Becoming old is a natural process, which cannot be stopped. While at the same time, preparing for a safe retirement period is also crucial for everyone. Similarly, the NRIs also look for such type of investment to safeguard their retirement period. And this is one of the main reasons why the NRIs seek investment in India.

- Returns: There is no doubt that any type of short-term investment plan will give some returns. In this aspect, the NRIs, mostly with their income, want to make some investment in India, which will further boost up their income in terms of returns. Therefore, they seek to invest in plans that give them a better interest rate and low risk.

- Generate more income for families: To meet their increasing family expenses in India and create a secured financial environment, the NRIs may try to generate some extra income in India. As a result, they look for some income-generating short-term investment that turns to be both a saving and an additional source of income for the family.

- Financial asset: Another primary reason for the NRI to invest is to create a financial asset. As a result, they will want to buy some property, creating a rental income. This can be used for their financial security as an additional income. This is also considered to be one of the fastest and secure ways of income-generating short-term investment options.

7 Best Short-Term Investments for NRIs in 2021

- Bank Fixed Deposit

- Mutual Funds

- Direct Equity

- Real Estate

- Bonds and Non-Convertible Debentures

- Government Securities

- National Pension Scheme

After knowing the reasons why an NRI should invest in India, here are the types of short term investment that will be effective and beneficial in 2021:

1. Bank Fixed Deposit

This fixed deposit in banks in India is the simplest and easiest way of short-term investment. This is safe and has unique plans for the NRIs like:

- Non-resident External Account (NRE): The interest rate is from 2% to 6% per year.

- Non-resident Ordinary Account (NRO): up to $1 million can be invested under this plan.

- Foreign currency Non-Resident (FCNR): The rate of interest for this type of plan will be 0.01 to 1.50%.

2. Mutual Funds

This is another popular type of investment for NRIs. There are many short-term mutual funds available for investors. Although mutual funds are a bit riskier when compared to fixed deposits, they still have the potential to give you more returns. Mutual funds are categorized under two types, and they are equity funds and debt funds.

3. Direct Equity

This type of investment is on the National Stock Exchange of India Ltd under the scheme Portfolio Investment scheme of the Reserve Bank of India. This will allow trading stocks on NSE.

4. Real Estate

People always have hope for real estate investment. This investment may range from investment on lands, income-generating built properties, agricultural land, and more. However, if you want to generate a quick and stable return, most NRIs may seek to invest in a constructed property that will quickly generate a rental income.

5. Bonds and Non-Convertible Debentures

Although this type of investment may involve risks, it can still be a good investment option if rightly handled. There are three types of bonds available: Public Sector Undertakings Bonds, Non-convertible debentures, and perpetual bonds.

6. Government Securities

The government also provides investment options for the NRIs, ranging from 3 to 12 months of maturity time. This may include fixed-rate government bonds, floating-rate government bonds, and capital index bonds.

7. National Pension Scheme

This pension scheme will allow NRIs and Indian citizens to save for their retirements. However, the applicant should be between the age of 18 and 60 years. Such investment comes under Tire 1 Account and Tier 2 Account.

With many short-term investments to make in India, it undoubtedly gives you the best returns and can also be turned to be a passive income for the NRIs over the days. However, taking the advice of a skilled financial planner or an advisor can further help decide which plan would serve to be the best one according to an individual’s expectations.