What are the tax benefits of buying Term Insurance?

Term insurance policies are the first choice of people looking to secure their families’ financial stability after their demise. It has to be understood that life is uncertain, and within a fraction of a second, anything can happen to anyone. During such times, having a term insurance plan acts as a shield and reduces the financial burden to a great extent. In addition, term plan tax benefits are also another reason why these plans are suggested by investment advisors to plan your income tax.

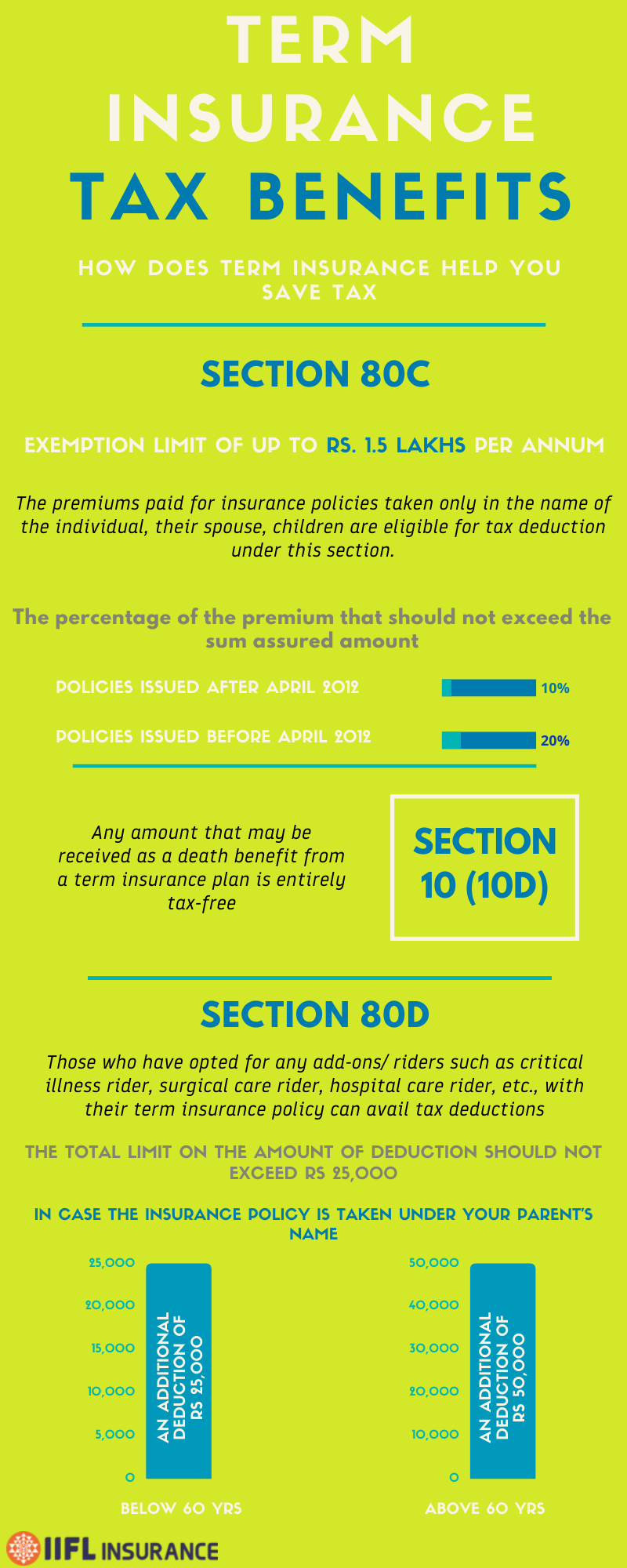

How Does Term Insurance Help You Save Taxes?

The primary purpose of taking a term insurance policy is to provide financial security for your dependents. The coverage amount can be customized according to your risk and requirements, based on which the premiums are fixed, that can be paid monthly or annually. In case of any unfortunate events to yourself, such as death, accident, disability, etc., the coverage amount or sum assured is paid by the insurance provider as a lump sum amount to the family members.

To encourage the purchase of insurance plans among all, the Income-tax department of India has made provisions for insurance policyholders to avail income tax benefits over premiums paid and amount receivable on maturity. The term life insurance tax benefits can be availed under the following sections of the income tax act:

- Section 80C

- Section 10 (10D)

- Section 80D

Let us see how these sections help in reducing your tax liabilities

Section 80C deduction on payment of life insurance premium

Tax benefits on total income can be availed under section 80C of the Income Tax Act 1961 for payments paid towards the premium of an insurance policy. The exemption limit of up to Rs. 1.5 lakhs per annum can be utilized by the policyholder, subject to the below conditions:

- The premiums paid for insurance policies taken in the name of the individual, his/ her spouse, and their children are only eligible for deduction under this section.

- The premium paid should not exceed 10% of the term plan’s sum assured, in case of policies issued after April 1, 2012. For policies issued before April 1, 2012, the premium should not be more than 20% of the plan’s sum assured. If the policy was purchased on or after April 1, 2013, and the policyholder suffers from any disability or disease, then the premium paid should not exceed 15% of the sum assured.

- The total exemption limit under section 80C is Rs 1.5 lakhs and investments made in tax saving schemes, PF, housing loan repayment, health insurance premiums, etc., also fall under the same category. Therefore, your term insurance premiums should be considered along with the other products mentioned above to calculate term plan deduction in income tax from your total income.

Section 10 (10D) tax exemption on receipt of life insurance amount:

Under section 10 (10D) of the Income Tax Act, any amount that may be received as a death benefit from a term insurance plan is entirely tax-free. No income tax needs to be paid on this amount provided it satisfies the below conditions:

- If the policy is issued on or before April 1, 2012, the premium should not be more than 20% of the plan’s sum assured, for the maturity or death benefit received from the plan will be considered tax-free. In case of the policy’s premium, higher than 20% of the sum assured, the benefit amount in its entirety shall be taxed. But, if the insured dies during the policy tenure, then the death benefit is not taxed, even if the premium is more than 20% of the sum assured.

- For policies issued on or after April 1, 2012, the insurance proceeds are not taxed only if the premium is up to 10% of the sum assured, or else the entire amount will attract tax.

Most people look only at the tax savings offered under section 80C while buying a term insurance plan. But the maturity amount also holds importance as that sum assured is the reason for opting for the term policy, and enough focus must also be placed on its taxation benefits.

Term Insurance tax benefits under Section 80D

It might be surprising for many to hear that you can avail of tax benefits on term insurance under Section 80D of the Income Tax Act, 1961. However, this section is primarily used to claim tax advantages on health insurance premiums.

Those who have opted for any add-ons/ riders such as critical illness rider, surgical care rider, hospital care rider, etc., with their term insurance policy can avail tax deductions, subject to fulfillment of the below conditions:

- The total limit on the amount of deduction should not exceed Rs 25,000

- An additional deduction of Rs 25,000 is allowed in case the insurance policy is taken under your parent’s name if they are less than 60 years of age.

- If parents are above 60 years of age (senior citizens) and a term plan is taken under their names, you may claim an additional Rs.50,000 as a tax benefit under section 80D.

Here is an illustration that will help you understand the tax benefits of term insurance policy in a much precise manner

Mr. Raju purchased a term insurance policy with Rs. 10 lakh sum assured and an annual premium of Rs.1.50 lakh. While 10% of the sum assured is Rs 1 Lakh, the premium paid is 1.50 lakh which exceeds the former. Hence Mr. Raju will get a tax deduction only on Rs 1 lakh under section 80C and not on the entire Rs 1.50 lakh premium paid. If this is a money-back policy, the maturity amount of Rs 10 lakh will also be taxed in full under Section 10 (10D) since the annual premium for the policy is more than 10% of the sum assured, making Mr. Raju pay the necessary tax on the maturity proceeds.

Term insurance must be taken after considering the benefits that it offers to yourself and your family members, as that is of utmost importance. The term insurance premium tax benefit and maturity amount benefits that are available on these plans are just a bonus for your future investment. So do not buy a term plan purely to save income tax only.