What should you know about the importance of medical tests in term insurance?

How practical is the term insurance medical test in helping you buy a high sum assured term policy at a low premium amount?

Anyone will want to buy a term plan at a low cost, with a high sum assured. But this may not be a possible scenario in all cases. There are, of course, a few factors that influence the premium amount and sum assured. In this aspect, health and age factors play a vital role.

For instance, Ravi, a 55 years old family man, is absolutely healthy and has no lifestyle diseases like diabetes, blood pressure, thyroid, or others. But he will obviously be restricted from taking a high sum assured, whereas he needs to pay a high premium if he wants to get a high sum assured.

At the same time, Pravin, a 28 years old young man, has all the qualifications to get a high sum assured at a lower premium amount. But unfortunately, he is a smoker and also has diabetes and blood pressure symptoms at a young age. Although the insurance company is ready to give him a term plan with a high sum assured and low premium rate, his health factor may limit him from getting that.

These two examples might have now given you a better idea about the importance of a medical test in term insurance.

Why need a Medical Test for buying a Term Plan?

We all know that our lifestyle has completely changed from what it was about 25 to 30 years ago. This is mainly due to the significant change in the work environment, food habits, and city life, which most of them are compelled to live for their livelihood. However, at the same time, the space to care for their health also gets limited to them because people today with the corporate lifestyle work for over 12 hours a day and hardly find time to relax and sleep. This obviously leads to many health issues at a very young age.

Understanding this change in the health scenario, most of the insurance companies have started focusing on providing term insurance medical and short-term medical insurance. But at the same time, before giving that medical insurance, the health status and other factors are considered. However, there are also term plans without medical tests, but they may have a different set of terms and conditions to be followed.

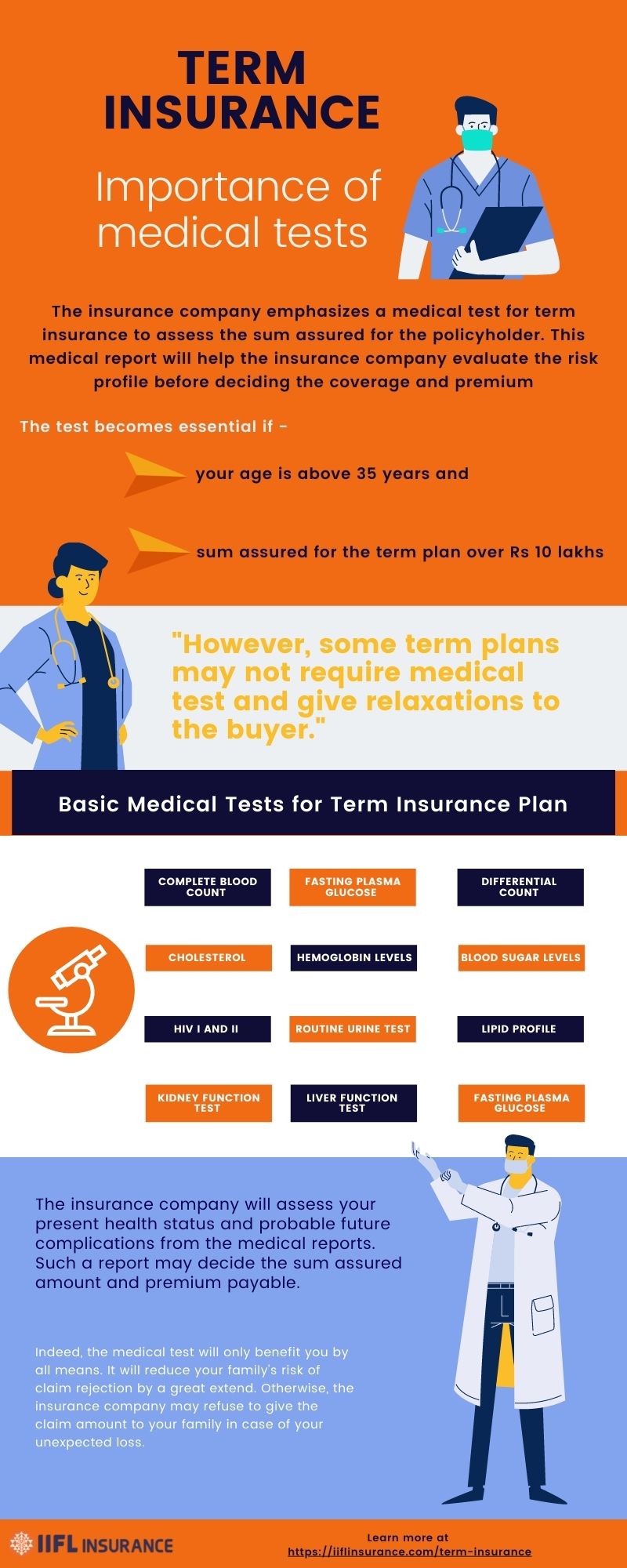

Basic Medical Tests for Term Insurance Plan:

Here are some essential medical tests that one should undergo before buying the term plan with high sum assured, especially:

- Complete blood count

- Fasting plasma glucose

- Differential count

- Cholesterol

- Hemoglobin levels

- Blood sugar levels

- HIV I and II

- Routine Urine test

- Kidney function test

- Liver function test

- Fasting plasma glucose

- Lipid profile

There are also a few additional tests taken according to the applicant’s present health scenario, and they may include:

- ECG

- Treadmill test

How important is a medical test?

The insurance company emphasizes a medical test for term insurance to assess the sum assured for the policyholder. However, this medical test is essential for both term insurance and traditional term insurance plans for spouse cover as well.

Here are a few more pointers that emphasize the importance of undergoing a medical test:

- The medical test for term plan coverage is mandatory if your age is above 35 years and

- If you have chosen a sum assured for the term plan over Rs 10 lakhs.

However, some term plans may not require medical test and give relaxations to the buyer, and such cases may come under the factors:

- When the applicant is less than 45 years of age and

- Whey, they opt for coverage above Rs 20 or Rs 25 lakhs

At the same time, if the applicant has any pre-existing illness, or family history, or hereditary conditions, then the insurers may want you to take a medical test. On the whole, the need for medical tests is subject to the insurer’s underwriting policies. Therefore, going through the medical grid as per your age, required sum assured, and other specifications are essential.

Why should you undergo a medical test?

The insurance company will assess your present health status and probable future complications from the medical reports. Such a report may decide the claim settlement ratio and sum assured rate, and premium payable.

In case you are found to have a health issue, then there is a chance of premature demise, and the insurance company may increase your premium payable. However, at the same time, there will also be a restriction on your sum assured or the insurance company may also reject the term plan proposal based on the medical test result.

Whereas, if you are found to be healthy, then the insurance company may offer you high coverage without any additional conditions or terms.

This medical report will help the insurance company evaluate the risk profile before deciding the coverage and premium.

Indeed, the medical test will only benefit you by all means. It will reduce your family’s risk of receiving the said sum assured in case of an unforeseen situation. Otherwise, the insurance company may refuse to give the claim amount to your family in case of your unexpected loss.

Therefore, if you are seriously bothered about protecting your family, try to undergo a medical test before buying the term plan. This will, by all means, give you only the advantage of getting a better term plan at the best premium amount and sum assured.