A Detailed Guide to Term Insurance

What is Term Insurance?

Term insurance is the traditional form of life insurance best to provide financial security for your family members and dependents in the event of your absence. This is achieved by availing a comprehensive life cover based on your family’s current and future needs, for which monthly or yearly payments in the form of premiums are paid. In short, the term life insurance meaning is quite simple – it helps to secure your family’s financial future after your demise.

Let us understand this better through an example. Mr. Kapoor, a senior manager, working for an IT MNC, had taken a term insurance plan of Rs 1 Crore, and paid Rs 10,000 as an annual premium for a policy term of 30 years. Living with his wife and two kids in a rented apartment, he was the sole earning member of the family. Despite his healthy lifestyle, Kapoor had a heart attack and passed away at the age of 35. Kapoor’s death was a significant loss for the family, but he had ensured financial protection for his wife and kids in the form of a term plan. After his demise, his family received the lump sum payout of Rs 1 Crore from the insurance provider which helped them to take care of house rent, kids’ education, and daily expenses. Without this term plan, Kapoor’s family might have been under a severe financial burden to manage their household spends, without Kapoor by their side.

While talking about term plans, most people think it is not the right insurance product for them because there is no return if the insured survives the policy term. But it has to be understood that term plans are pure protection plans and created to provide a high life cover for the lowest premium.

Moreover, with new insurance providers hitting the market and offering different types of policies, it becomes difficult for an ordinary person to choose a plan. In fact, there are many term insurance types also, which we have explained below, to help you select the desired plan of your choice.

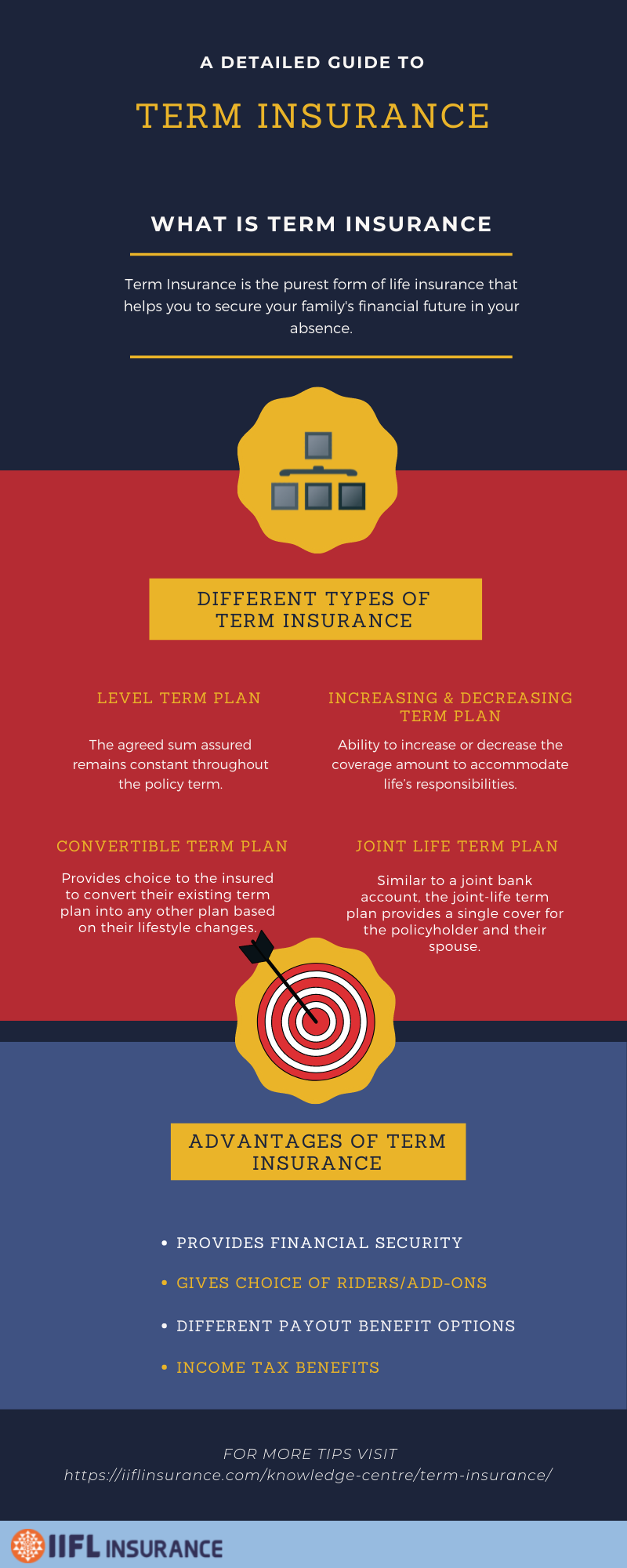

What are the different types of Term Insurance?

- Level Term Plan: This is the primary type of term insurance policy wherein the agreed sum assured remains constant throughout the policy term and is paid upon the demise of the person insured to his or her nominee. The premiums of this policy are the lowest compared to other plans. The possibility of choosing a higher coverage at an affordable premium is a significant advantage for people to opt for these policies.

- Increasing & Decreasing Term Plan: These are basic term plans, but with the ability to increase or decrease the coverage amount in regular intervals. Increasing term policy is helpful, especially for those who had started their careers and may want to increase the cover automatically to accommodate their life’s responsibilities as they grow. Under the decreasing option, the coverage is decreased on preset intervals for the entire policy tenure.

- Convertible term plan: This policy provides a choice to the insured to convert their existing term plan into any other plan based on their lifestyle changes. For example, one can opt to convert their basic term plan to an endowment plan or money back plan, or whole-life plan after a few years, to take advantage of the features of that specific policy while retaining the insurance coverage.

- Joint Life Term Plan: Similar to a joint bank account, the joint-life term plan provides a single cover for yourself and your spouse. In the event of any unforeseen death to either of them during the policy tenure, the surviving partner receives the death benefit and future premiums are nullified. On the demise of both parties, the death benefits are passed on to their legal heirs.

What are the Advantages of Term Insurance?

Having gone through the term insurance types, it is time to look at the benefits of having a term plan in your portfolio.

- Provides lifetime security: A term plan is a product that is designed primarily to secure the financial commitments of your loved ones, even after your demise. It not only protects you from sudden life events but also helps in creating a buffer for your family members to handle their daily expenses and maintain the same kind of lifestyle throughout their life when you are physically absent from their lives.

- Choice of Riders/add-ons: Many times, you would feel the existing policy is lacking in a few areas or might want to enhance it further, considering the future requirements. A term plan has facilities to top-up in the form of riders, which comes at an additional cost over the premium, extending your policy benefits. One important rider that can be added to the term policy is the critical illness rider, which protects against critical illnesses like cancer, heart attacks, kidney transplant, etc. Some other standard riders are an accidental death benefit, accidental disability benefit, and waiver of premium benefit rider amongst others.

- Different payout benefit options: The financial benefit that one receives is the prime reason to opt for a term insurance plan. In some cases, your family might not be able to handle a lump sum amount as a death benefit, but instead, a monthly payout would help them. Therefore, term policies provide you with options to customize the plan in such a way that a regular monthly income is paid to your family after your demise. The types of payout options include Full Lump Sum Payout, Lump Sum + Regular Monthly Income, Lump Sum + Increasing Monthly Income.

- Income Tax benefits: By buying a term insurance plan, you not only secure the financial future of your dependents after your death but also save on your income tax during your lifetime. The premiums paid up to Rs 1.5 lakhs per year towards your term policy fetch tax exemption under sections 80C and 80D of the Income Tax Act 1961. Similarly, the death benefit received is exempted under section 10 (10D) of the Income Tax Act 1961 which means, your family is not required to pay any tax over the insurance coverage amount.

The bottom line is life is unpredictable and uncertain, but we can always plan for it accordingly by making necessary arrangements in advance and minimizing the losses that one may encounter in the future. Availing of a term insurance policy must be your first step in achieving this goal. In case you are looking for a term insurance policy, then visit iiflinsurance.com, fill in your details, and get details about different term plans.