Health Insurance for Knee Replacement Surgeries and why is it worth it?

Mr. Sahay (62-years-old) is a retired employee from an eminent private firm who lives in Ahmedabad with his wife. Mr. Sahay was suffering from excruciating knee pain for the last 1 year and he consulted with several doctors and opted for many treatments to control his pain and discomfort. But nothing has worked and thus, the doctor recommended him for joint replacement surgery in India. As Mr. Sahay is insured under a comprehensive individual health insurance plan, he opted for knee replacement surgery last month. The total cost of the operation was Rs.2 lakh, but thankfully, he selected an empaneled hospital of his insurer, and thus, he didn’t need to pay a single penny. Now, Mr. Sahay is recovering, and the doctor prescribed him some medications and exercises that will boost his recovery.

Being a farsighted person, Mr. Sahay had purchased a health insurance policy that offered him adequate coverage for his knee replacement surgeries. But many people are still not aware of knee replacement health insurance policies and how these knee cover plans are advantageous for their surgeries and treatments.

Let’s take a closer look at health insurance for knee replacement and how you can get benefits from this type of health plan.

Knee pains are common for older people as their knees become very weak and they hardly respond to conventional treatments. Thus, they often need knee replacement surgeries to regain the normal functionalities of their knees.

Some causes of knee replacement

Osteoarthritis is the prime cause of knee pain and the one which needs knee replacement surgeries among people. Apart from osteoarthritis, rheumatoid arthritis, ligament tears, injuries, and other cartilage defects may increase your knee pain and cause enough damage to your knees. Thus, knee replacement surgeries are being increasingly recommended by specialists to get rid of persistent pain and stiffness.

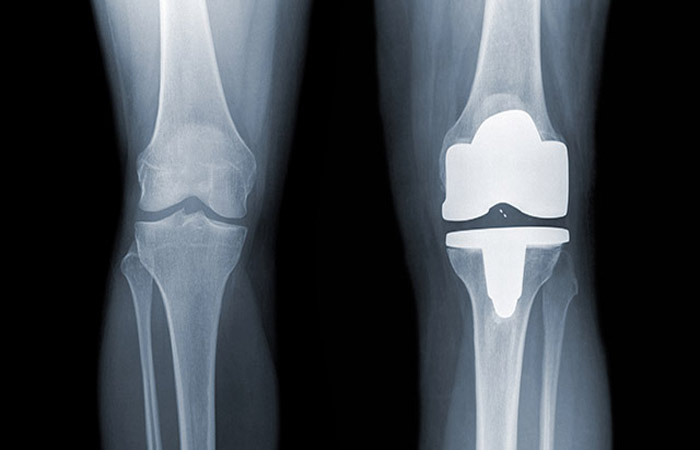

A knee replacement is an intricate surgery where professional orthopedic doctors replace your injured bones and the cartilage with artificial joints or prosthetics.

Types of knee replacement surgeries

Let’s take a look at the different types of knee replacement surgery.

- Total knee replacement: Under this type of surgical procedure, your whole knee is replaced with prosthetics by experienced and skilled surgeons.

- Partial replacement: This type of surgery is recommended only for the affected or injured areas of your knees.

- Bilateral knee replacement: In this type of surgery, the experts replace both knees at the same time.

Since knee replacement is a critical condition and the costs are quite high, most insurers cover this surgery under their critical illnesses plans.

What is the cost of knee replacement surgery?

Based on your physical conditions, pre-existing diseases, your locality, and your hospital, the cost of knee replacement surgery may vary. Knee implant cost in India is nearly Rs. 50,000 – Rs. 2 lakh because hospitals/healthcare facilities need to import these prosthetics and they are very expensive. While going for knee replacement surgeries, you must weigh other add-on costs. These costs can be,

- Your duration of hospital stay

- Physiotherapy costs (if you need them at the hospital)

- Follow-ups especially after the operation

- Any other therapy that may boost up your recovery

- Transportation cost

- Extra healthcare tests and health check-ups

While calculating the costs of your knee replacement surgery, you must include all these parameters.

Is knee replacement covered under insurance?

Knee pains are severe and will be more agonizing if you don’t take any treatment. A successful knee replacement surgery will help to overcome your pain and uneasiness. You will regain your knee strength and flexibility and also, can lead a pain-free wholesome life. Knee replacement surgeries are expensive affairs and will give you enough stress financially if you don’t have any health insurance policy. To lessen your financial stress and agony, purchase a health insurance policy that offers a sufficient sum insured amount for your knee replacement surgery.

Here are some of the benefits that you can enjoy while purchasing knee replacement health insurance.

- Cashless treatment facility: You don’t need to pay a single penny for your operation if you select a network hospital of your insurance company. Because your insurer will directly pay the bill amount to the hospital. Book your hospitalization in advance to enjoy hassle-free services.

- Cover for treatment: A standard health insurance from an established insurance company will offer you coverage for your pre and post-hospitalization, in-patient expenses, room rent, doctor’s fees, etc. With a comprehensive health insurance policy, you can only focus on your treatment.

Things you should check before selecting a knee replacement surgery

- Previously, most health insurers used to consider knee replacement surgery under the category of cosmetic treatments or implants. But now things have changed and health insurers are offering reimbursement for knee replacement surgeries.

- Always consider the waiting period and other parameters like your premiums, add-on facilities, policy terms & conditions, etc., before purchasing a health insurance policy for knee replacement. For many companies, the waiting period is nearly 2-4 years. This implies within this phase, you can’t initiate a claim for your knee replacement treatment.

- Most health insurance policies only offer a certain percentage of knee replacement treatment costs. So, check your policy thoroughly before purchasing it.

Always perform some activities that will keep your knees and bone muscles healthy and flexible. Knees are an important part of your body, but they become weak and vulnerable to old age. So, it would be a prudent decision if you purchase a health insurance policy for knee replacement and use the policy if there is a need in the future.