Why should you buy a LIC Tech Term Plan?

Recently, Vinay got married to his long-time girlfriend, Sheela, and moved into a new apartment that he had purchased on loan. His wife was also contributing to the repayment of the loan enabling the couple to plan their other finances quite easily. But Sheela lost her job during the COVID-19 pandemic and did not want to join again as she was pregnant.

Vinay now had to plan appropriately to manage the household expenses, take care of his wife during pregnancy, and also make necessary investments for the future. The first thing Vinay did was to purchase an online term insurance policy for Rs 1 Crore, so the payout benefit would cover his existing liabilities and help his family have a safe future. Moreover, he had to pay only Rs 9000 as a yearly premium which was very cheap compared to the cost of other insurance plans.

One such policy is the LIC tech term plan that offers a sum assured of Rs 1 crore at affordable premiums and can be purchased online. So, what exactly is the LIC tech term plan? Let’s explore in detail:

What is LIC Tech Term Plan?

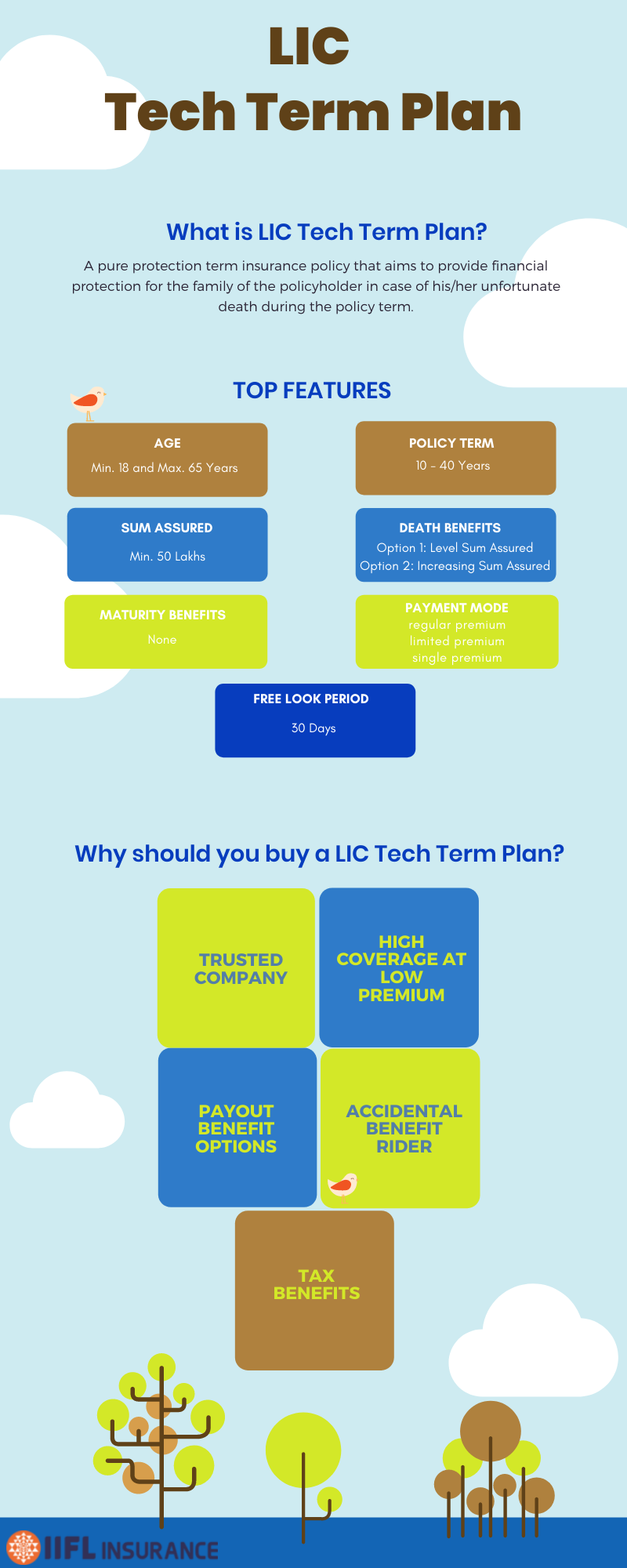

LIC tech term plan is a pure protection term insurance policy that aims to provide financial protection for the family of the policyholder in case of his/her unfortunate death during the policy term.

Eligibility Criteria of LIC Tech Term Plan

| Parameters | Details |

| Policy Duration | 10-40 years |

| Premium Term | Regular Payment- Same as policy tenure

Limited Payment- Policy minus 5 years (for 10-40 years policy tenures) Policy tenure minus 10 years (for 15-40 years policy tenure) |

| Payment Mode | Regular & Limited Pay – Half Yearly and Yearly |

| Age Limit | Minimum Age: 18 years

Maximum Age: 65 years |

| Maturity Age | 80 years |

| Grace Period | 30 Days |

| Sum Assured | Minimum- Rs. 50,00,000/-

Maximum – No limit |

| Liquidity | No loan available |

7 Top Features of LIC Tech Term Plan

Here are some salient features of this plan:

- The age of the insured must be minimum of 18 years and a maximum of 65 years.

- The policy term ranges from 10 to 40 years.

- There is no maximum limit on the coverage that you can choose, but the minimum sum assured is Rs 50 lakhs.

- You can receive the death benefits under two options: Option 1: Level sum assured & Option 2: Increasing sum assured.

- There are no maturity benefits under this plan.

- The insured can select between regular premium, limited premium, or single premium option with an annual or half-yearly mode of payment.

- LIC provides a free look period of 30 days, within which a policyholder can return the policy and easily get a refund of the premium paid, in case they are not satisfied with the terms and conditions applicable to the policy.

Why should you buy the LIC tech term plan?

1. Trusted company: Formed in the year 1956, the Life Insurance Corporation of India (LIC) is the oldest and the only recognized public sector life insurance company in India. Since the government holds a majority stake, customers trust LIC very much instead of private life insurers. With 2000 branches & lakhs of agents, LIC has a considerable presence across the nation which has made it easy for any person to buy their policies. The claim settlement ratio (CSR) of LIC for the year 2019-20 stands at 96.69%, which is also impressive considering the total number of policyholders.

2. High coverage at a low premium: With risks involved in life, it is essential to choose a sum assured that not only provides safety for your family members in your absence but also helps them tame the increasing cost of living. By choosing to buy LIC tech term online, broker commissions are eliminated, which reduces the policy premium to a great extent. For example, a 30-year-old non-smoking male who avails this policy for a sum assured of 1 crore and policy term of 30 years needs to pay Rs 9,000 per year only as a premium.

3. Payout benefit options: The death benefit under this plan can be received as Level sum assured or increased sum assured.

- Level sum assured: The sum assured remains fixed throughout the policy term.

- Increasing level assured: In this option, the amount of sum assured to be paid on the death of the policyholder remains the same till the end of the 5th policy year. From the 6th policy year to the 15th policy year, the basic sum assured increases by 10% every year until it becomes twice the basic sum assured. After the 16th policy year, this new sum assured remains constant.

- LIC also provides a facility to receive the death benefits in installments of 5 or 10 or 15 years instead of a lump sum. The policyholder must choose this option at the time of taking the policy.

4. Accidental benefit rider: Among all the LIC tech term plan benefits, the ability to enhance your coverage by opting for an Accidental benefit rider for an additional premium is the most important. So, in case the policyholder suffers accidental death, the rider sum assured shall be payable as lumpsum along with the death benefit.

5. Income tax deductions: The LIC tech term plan offers income tax benefits on premiums and payouts. While you can claim deductions for the premiums paid under Section 80C of the Income Tax Act, 1961, the payout of the sum assured is also tax-exempt under Section 10(10D) of the income tax laws.

Documents Required to Buy LIC Tech Term Plan

Here is the list of documents required to purchase a LIC Tech Term Plan as mentioned below:-

- Identity Proof – Passport, Aadhar Card, Voter ID

- Address Proof – Aadhar, Driving License, Ration Card, Electricity Bill, Water Bill, and Passport

- Income Proof – Salary Slips or IT returns.

So, don’t you think the LIC tech term plan’s features and advantages are plenty, making it a good choice for you to secure the financial commitments of your family and dependents in your absence? Then don’t just search for LIC tech term buy online articles but instead, proceed to buy the policy.