How to know whether your Term Insurance covers death due to COVID-19 or not?

COVID-19 could well be called the most extensive health scare of the century. With the World Health Organisation (WHO) declaring it as a pandemic, all countries worldwide are trying their best to contain the spread of the virus among their citizens. But, unfortunately, India is also one of the severely affected nations with a vast population, with millions losing their lives.

On account of lockdown measures, many employees lost their jobs and took pay cuts making life difficult. The necessity of a term insurance plan couldn’t be more strongly stressed during these situations. It helped many families handle their financial situation while still coping with the loss of their dear ones.

Arjun Singh, a 38-year-old businessman, was diagnosed with COVID-19 after his business visit from China. His wife and two kids were also found to be positive for the virus. All were admitted to a private hospital for treatment. His wife and kids could recover fast since their infection was only mild, but Arjun was not responding well and had to put on a ventilator. Unfortunately, despite all the efforts of doctors, Arjun passed away, leaving the entire family in despair. With the only earning member of the family no more, his wife was left to settle the hospital bills, take care of the kids, handle the family business, and manage the household.

To the rescue came Arjun’s term insurance policy that he had taken for Rs 1 crore sum assured after marriage. Arjun’s wife being the nominee, filed a claim request with the insurance company, and she received the payment in a lump sum within a few weeks. This helped her streamline everything leftover by Arjun and bring the family back to a proper shape soon. Though Arjun’s absence is sure to be felt, his decision to buy a term plan at his young age has saved the family from any financial crisis now.

Why Term insurance?

A term insurance policy is designed to secure your family’s financial commitments if an unfortunate event happens to you, such as death, accident, or critical illness. In such situations, the sum assured is paid to your nominee that allows them to handle the life responsibilities, achieve the goals and maintain a good lifestyle without any financial trouble.

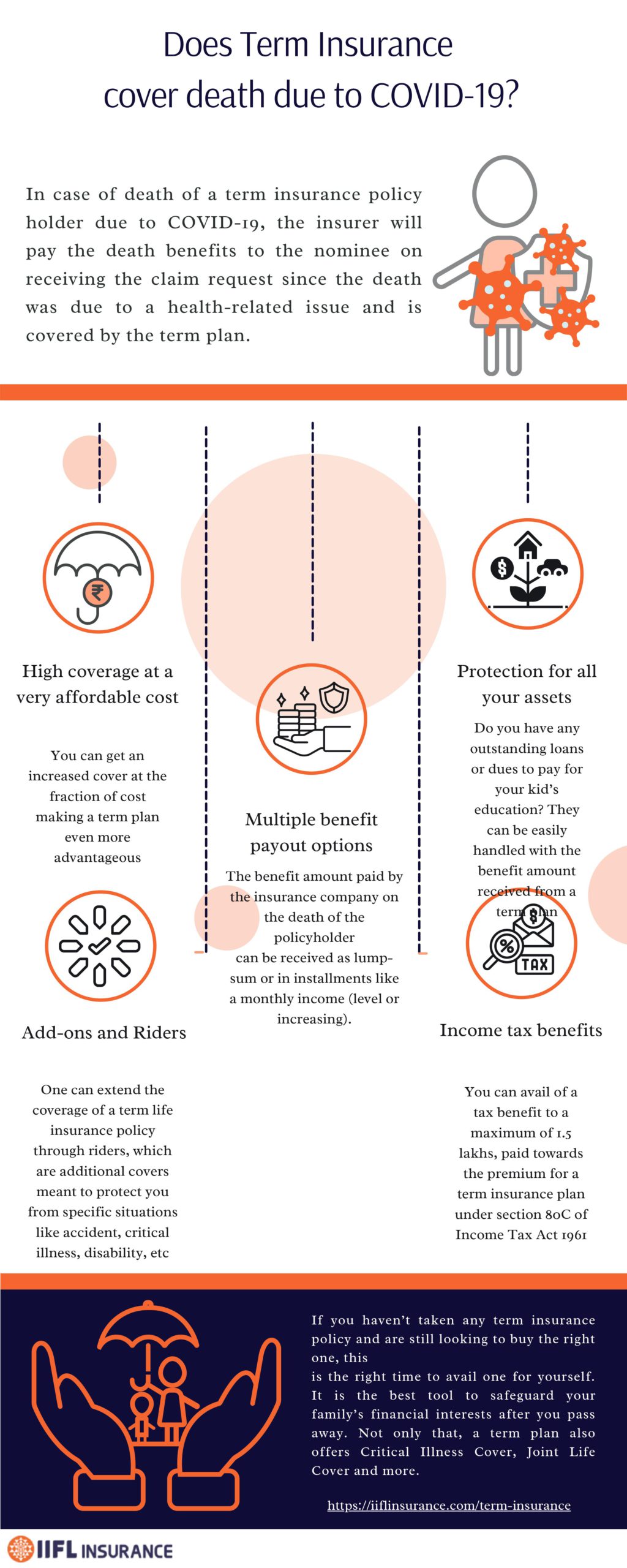

Now, the biggest question is, does a term insurance plan cover coronavirus? Yes, if you already hold a term plan and die due to COVID-19 disease, the insurer will pay the death benefits to your nominee on receiving the claim request since the death was due to a health-related issue and is covered by the term plan.

Best term insurance plans in India

If you haven’t taken any term insurance policy and are still looking to buy the right one, this is the right time to avail one for yourself. It is the best tool to safeguard your family’s financial interests after you pass away. Not only that, a term plan has multiple other advantages, including the much-needed financial assistance for you to handle the costs related to the latest illnesses such as COVID-19.

The best 5 term insurance plans in India are listed below that assures protection against uncertainties like COVID-19 and maturity/ survival benefit, income benefit, critical illness cover, etc.

| Plan Name | Entry Age (Min/ Max) in years | Policy Tenure (Min-Max) in years | Sum assured (minimum) | Claim Settlement Ratio (CSR) |

| LIC Tech Term | 18 -65 | 10 – 40 | ₹ 50 lakhs | 96.69% |

| HDFC Click2Protect Plus | 25 – 65 | 5 – 85 | ₹ 10 lakhs | 99.07% |

| Max Life Smart Secure Plus Plan | 18 – 65 | 10 – 67 | ₹ 20 lakhs | 99.35% |

| Tata AIA Maha Raksha Supreme | 18 – 65 | 10 – 40 | ₹ 50 lakhs | 99.06% |

| Canara HSBC OBC iSelect Star Term Plan | 18 – 65 | 5 to 60 | ₹ 25 lakhs | 98.12% |

| Kotak e-Term Plan | 18 – 65 | 5 to 40 | ₹ 25 lakhs | 96.38% |

Benefits of buying term insurance:

A lot is said about the financial security that a term insurance policy provided to its beneficiaries. But there are more benefits to this product, which are explained below:

- High coverage at a very affordable cost: To buy a term policy with a high sum assured means the finances of your family will be handled properly, even after you pass away. The fact that you can get an increased cover at the fraction of cost makes a term plan even more advantageous. For example, Rs 1 crore term insurance policy can be bought for a yearly premium of just Rs 5000.

- Protection for all your assets: Do you have any outstanding loans or dues to pay for your kid’s education? They can be easily handled with the benefit amount received from a term plan allowing your family to protect the assets earned over the years.

- Multiple benefit payout options: The benefit amount by the insurance company on the death of the policyholder or maturity of policy can be received as lump-sum or in installments like a monthly income. These options on payout mode and frequency can be exercised by the insured when taking the policy, considering the future needs of your family members.

- Add-ons and Riders: One can extend the coverage of a term life insurance policy through riders, which are additional covers meant to protect you from specific situations like accident, critical illness, disability, etc. For a slightly extra premium, one can choose from a critical illness rider, accident benefit rider, income benefit rider, waiver of premium rider, etc.

- Income tax benefits: A term insurance plan offers tax benefits on the premiums paid and benefits payouts that your family might receive on maturity. You can avail of a tax benefit to a maximum of 1.5 lakhs, paid towards the premium for a term insurance plan under section 80C of Income Tax Act 1961. Similarly, the benefit payout is exempted from tax under Section 10 (10D), and Section 80D provides exemption on the premium paid towards health-related coverage.

The bottom line is term insurance is an inevitable necessity in today’s time. If you are looking to buy term insurance for the future financial security of your family, you can visit iiflinsurance.com