What is an Equity Linked Savings Scheme (ELSS)?

Karan is a keen investor and keeps investing in many schemes, including mutual funds. He has a risk-taking attitude which has made him a successful investor. He has incurred both significant losses and high returns on his investments. But now, he is tired of giving away a part of his earnings as tax. He wants to invest in mutual funds for the higher rate of returns but also wants to avoid tax.

If you, too, are experienced in mutual funds investing but are tired of paying tax, you can start investing in ELSS mutual funds, which is an equity-linked savings scheme or ELSS funds. These are also known as tax saving mutual funds.

Keep reading this blog post to know more about ELSS and best tax saving mutual funds.

What is Equity Linked Savings Scheme (ELSS) Fund?

An equity-linked savings scheme or ELSS is an equity fund that invests a significant portion of its corpus into equity or equity-related instruments. This is beneficial if you are looking from getting exempted by the tax. The ELSS funds are also called tax saving mutual funds as an ELSS scheme offers up to Rs. 150,000 tax exemption from the annual taxable income under 80C of Income Tax Act.

The ELSS mutual funds have a compulsory lock-in period of three years. As the name equity-linked savings scheme states, it is an equity-oriented mutual fund scheme. It is called tax saving mutual funds as an ELSS scheme offers up to Rs. 150,000 tax exemption. The return on investment of an ELSS mutual funds is called long-term capital gain (LTCG).

Features of Equity Linked Savings Scheme (ELSS) Mutual Funds

Following are some features of ELSS Funds-

- A minimum of 80% of the total investible corpus is invested in equity or equity-related instrument.

- The funds invested in equity or equity-related instruments are done in a diversified manner, and it is done across different market capitalization, sectors, and themes.

- The lock-in period for elss is a minimum of 3 years. There is no upper limit or maximum tenure of investment.

- It is the best tax saving mutual funds as tax exemption under Section 80C of the Income Tax Act.

- The income generated is treated as Long Term Capital Gain or LTCG, taxed according to the existing tax rules.

Top 5 ELSS Funds in India 2021

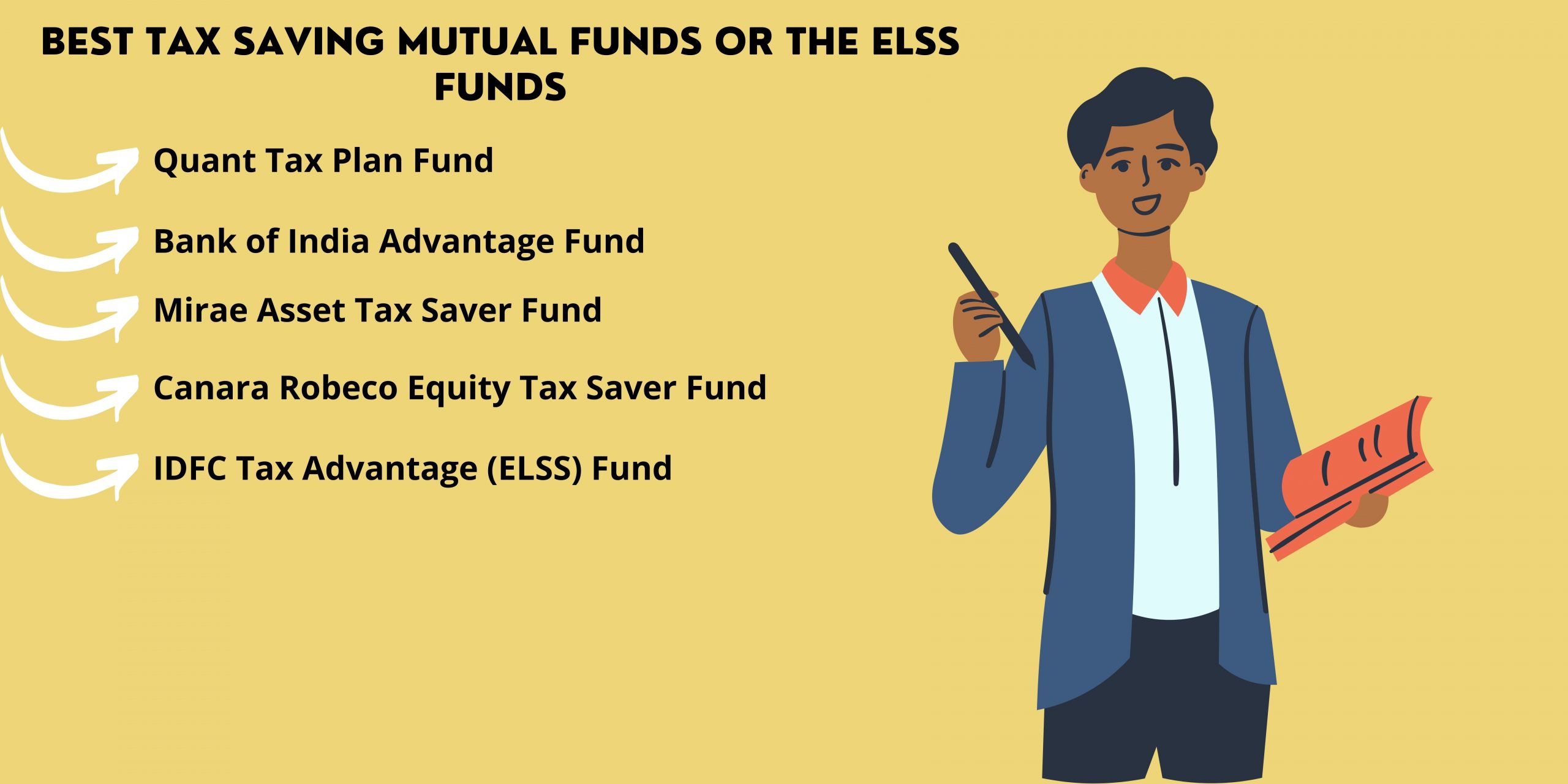

Following is the list of the best tax saving mutual funds or the elss funds.

- Quant Tax Plan Fund– LTCG of 38.55% in 3 years.

- Bank of India Advantage Fund– LTCG of 29.61% in 3 years.

- Mirae Asset Tax Saver Fund– LTCG of 25.51% in 3 years.

- Canara Robeco Equity Tax Saver Fund– LTCG of 25.18% in 3 years.

- IDFC Tax Advantage (ELSS) Fund– LTCG of 23.22% in 3 years.

Tax Benefits under ELSS Mutual Funds

As mentioned many times in this blog, this mutual fund is known for its tax exemption feature. Under Section 80C of the Income Tax Act, this scheme offers tax deduction benefits on the principal invested under elss mutual funds.

The tax is cumulatively deducted, up to 1.5 lakhs for investments made in instruments like elss, ppf, nsc, etc. These schemes have a mandatory lock-in period of 3 years. The returns gained are called long-term capital gains or the LTCG. If these gains are up to Rs 1 lakh in one financial year, they are not taxable under this section. If your long-term capital gain is above 1 lakh, it is taxed at 10% of the gains exceeding this limit.

Benefits of investing in ELSS Mutual Funds

The equity-linked saving scheme gives a wide range of benefits to the investor, which includes-

- Diversification– the elss funds are known for investing across a diverse and varied group of companies. These companies range from small-cap companies to large-cap companies. It is also invested across various sectors and themes. This helps you explore more investment grounds and enables you to enhance your portfolio as an investor.

- Low minimum amount– the amount to be invested under the elss is at times as low as Rs. 500 for investors who are willing to invest in elss funds. This also helps to start investing without accumulating a reasonable investible corpus.

- Systematic Investment Plan– It is also known as SIP. In an elss fund, you can either invest a lump sum amount or by SIP. SIPs are preferred over the lumpsum method by most investors as it allows them to invest in small amounts and avail of the tax exemption. This also allows them to create wealth more.

- Tax benefits– The elss funds are also called tax saving mutual funds as an elss scheme offers up to Rs. 150,000 tax exemption from the annual taxable income under 80C of Income Tax Act. If the gains are up to Rs 1 lakh in one financial year, it is not taxable under this section. If your long-term capital gain is above 1 lakh, it is taxed at 10% of the gains exceeding this limit.

Conclusion

An equity-linked savings scheme can save you from taxes and give you diverse grounds of companies to invest in. Start an ELSS mutual funds investment today to get high returns on minimal investments.