Old Income Tax Slab

In India, each earning citizen needs to pay tax. The tax is generally imposed on the total income earned by an individual. There are different income tax slabs based on which the total tax to be paid can be calculated. Each year, the finance minister announces new tax slabs to replace the old tax slab. It has new tax rates for different types of taxpayers.

Recently in the year 2020, the finance minister of India, Mrs. Nirmala Sitharaman announced new tax slabs. The new union budget announced on 1st February 2020 had new income tax slabs that were imposed to replace the old regime tax slab. This was announced for the benefit of senior citizens, HUF, and regular individuals.

The union budget claimed that the new tax regime is better than the old tax slab but many experts stated that the new regime that proved to be concessional came with an associated cost. Before one could understand the difference between the two, it is important to understand what income tax is and what are its slabs?

What is Income Tax?

In general terms, income tax is a type of tax that an individual needs to pay to the government. This tax is imposed by the government on an individual’s income. The income tax paid by citizens’, acts as a source of income for the government that is used for paying government obligations and funding other benefits to the public.

Income Tax Slabs

There are general tax slabs depending on which tax is imposed on individuals. Slab systems include detailed information about tax rates to be imposed on different ranges of income. On the basis of these slabs, it is easy for an individual to calculate the total amount of tax to be paid.

Each year, these slabs and tax rates keep on changing. The rates mentioned in the old regime tax slab may differ from the new one and thus it is important to ensure this before paying a tax. The tax slabs in India are maintained to ensure a fair tax system for citizens.

What do you mean by Old Tax Slab?

Each financial year brings in a new tax slab for the income tax payees. Each year people there is also a comparison between the two. This year as well the new tax slab differs from the old tax slab. What was unique about this budget was that the tax payee had a choice to file his income tax either as per the old regime tax slab or the new one.

The old tax regime was beneficial in a way that even when it had higher tax rates; it allowed individuals to reduce their tax liabilities in many ways. While it is compulsory for each citizen to pay income tax from their salary, there were ways by which one can reduce the total amount of tax and this was investing into instruments. The old regime tax slab allowed taxpayers to enjoy about 70 exemptions and deduction choices such as EPF, home loan repayment, NSC under Section 80 C, health insurance premiums under Section 80D, etc.

What is the New Tax Slab?

The New tax slab is different from the old tax slab. Though the new regime has introduced new tax slabs for taxpayers, it comes with an additional cost. In order to enjoy various benefits, one needs to forego certain deductions. Neither category of an individual taxpayer, be it self-employed or salaried, would be able to claim the exemptions.

Old Tax Slab Vs New Tax Slab

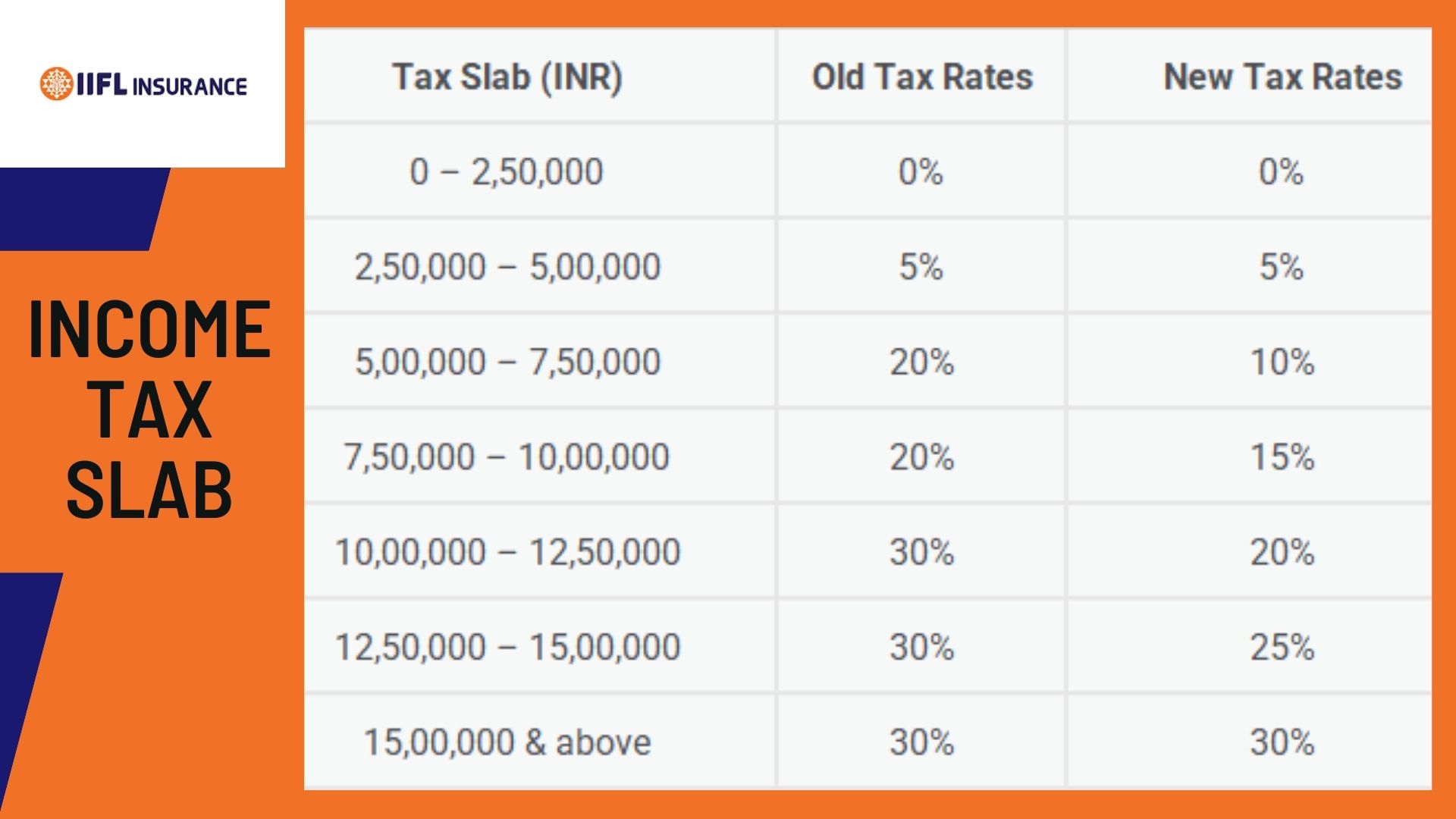

It would be easier to understand different tax rates under the two slabs with this table:

| Tax Slab (INR) | Old Tax Rates | New Tax Rates |

| 0 – 2,50,000 | 0% | 0% |

| 2,50,000 – 5,00,000 | 5% | 5% |

| 5,00,000 – 7,50,000 | 20% | 10% |

| 7,50,000 – 10,00,000 | 20% | 15% |

| 10,00,000 – 12,50,000 | 30% | 20% |

| 12,50,000 – 15,00,000 | 30% | 25% |

| 15,00,000 & above | 30% | 30% |

Advantages and Disadvantages of the Old Regime Tax Slab

While announcing the new tax regime, the finance minister allowed the taxpayer to choose the best suitable regime as per one’s choice. However, this made it quite complicated for many to decide which one to choose.

Here is a list of pros and cons of the two, which can help you to decide which one to select for paying your income tax

Pros of the old regime tax slab

- Enforced investments: The old slab forced investment and this cultivated a habit of investment in an individual. This helps save a good amount for future events such as a child’s education, marriage or medical expenses.

- Enhanced gross saving rate of the country: The old regime contributed to an overall saving rate of 30% by 2019 in India.

Cons of the old tax slab

- Lock-in period for saving instruments: It does provide tax benefits for saving instruments but most of the instruments have their own lock-in period that ranges from three to five years. This restricted millennial spending and senior citizens to keep cash in hand.

- Restriction on the saving instruments: This restricts the income taxpayer to invest only in those funds that are star-rated. They cannot invest in high-risk funds that ensure good returns in specific periods.

Pros of new regime tax slabs

- Reduced tax rates and less complication: The new slab allows concessional tax rates to the income taxpayer. In this slab, there are no exemptions and deductions and thus it requires fewer documents. This has made it simple and easy to file for tax.

- No restriction for saving instruments: As the new regime does not allow any exemptions depending on saving instruments and hence there was no restriction for investing in particular instruments with a lock-in period.

- More liquidity in hands: As there is no investment in instruments with a lock-in period, taxpayers can now keep a more disposable income.

Cons of the new tax slabs

- No deductions in tax rates: Unlike the old regime, the new regime does not allow any tax benefits or deductions for the taxpayers.

An individual taxpayer can choose any of the two to pay the income tax. Before one can choose between the old regime tax slab and the new tax slabs, it is important to identify the pros and cons of the two. Only once you know these differences, you would be able to make a well-informed decision.

The advantages and disadvantages may differ for different individuals. A taxpayer, who wishes to invest in a high-risk instrument can choose to pay his tax as per the new regime and the one who is looking for better deductions must opt to pay with old tax slabs. Therefore, take a decision based on the composition of your income.

Whichever tax slab you choose, it is important that you pay your tax on time so as to avoid any penalties in the future. Remember, as a loyal citizen of the country, you must pay tax to contribute to the growth of the country.