Calculating Your Health Insurance Coverage

In this fast-paced world, health is one thing which is neglected the most, by most of us. The daily schedules are so tight that there is no room for self-health and preventive care. Negligence in anything in this world has its own set of repercussions. In this case, it comes with health-related problems. It could be contracting some disease or obesity with a sedentary lifestyle or just some mental health issue. Nobody can eliminate exposure to all the health problems; that is almost impractical. With diseases, comes the cost of remediation. In today’s time, medical and health care expenses have sky-rocketed. While it is not possible to eliminate the vulnerability to diseases, it is undoubtedly possible to minimize its impact on our lives. By getting the best medical cover, we can make sure that we’re financially protected against medical conditions and emergencies.

In such situations, the health insurance policies plays a crucial role because it covers all essential health benefits that are required to take care of your health. And at the time of an accident or future medical treatment, it protects you from any unexpected and high medical costs. However, what is an ideal insurance cover that safeguards all the financial losses? The best health insurance policy for you that aligns completely with your needs as well as budget?

Yes, that is correct. More than having an insurance cover, it is essential to understand the right size and adequate insurance cover. You cannot just choose the size of cover at random. You need to assess your medical needs and get the best medical cover that is aligned with your medical needs and budget.

Why is adequate health insurance cover important?

Health insurance plans ensure that if you or any of your loved ones have to undergo any medical treatment due to medical emergencies, then you do not have to face any financial burden. Just by paying a small amount of premium, the insurance cover acts as a protective covering to you and your family in the event of any medical expenses. It also ensures that the insured will get an assured basic minimum quality service. In case, you are facing any medical costs and you do not have insurance, then it could seriously jeopardize your wealth. The top mediclaim policies are highly customizable and allow you to customize the insurance plan according to your needs and get the best medical cover.

The adequacy of any insurance plan depends on your needs. Many individuals do not have their policy cover as they are part of a corporate group policy. In case the insurance cover provided by the corporate plan is adequate, the individual may not want to have an individual plan as well. They can still take an add-on policy with a higher deductible to factor in the corporate cover. Get the best health insurance policy for yourself and your family that ensures that the amount and features of the plan reflect your insurance needs.

Things to keep in mind while assessing the adequate coverage

As health insurance provides the necessary financial support as well as mental strength in case of a medical emergency, it is furthermore vital to focus on adequacy. Lack of adequate insurance cover is as good as no insurance coverage as it fails to resolve the problem of the financial burden. Top mediclaim policies provide excellent coverage features for highly reasonable premiums that can be easily tailored to suit your needs.

Further, it is vital to reassess the amount of coverage on a regular basis. It is very much possible that the current health insurance coverage might not be good enough with increasing medical inflation and higher healthcare costs. To assess the adequacy of the health insurance policy, here are some questions that you need to answer.

- Whether the existing health insurance policy adequate?

- Are you satisfied with the services and the benefits provided in the current insurance policy?

These two simple questions answer the services and benefits related problems and the sufficiency and the adequacy related issues.

Further, the question of adequate insurance can be answered by considered the following parameters.

- Age: First of all, age is a very crucial factor that affects the design of the insurance policy. If you are young, you are less prone to diseases and bear a higher immunity. Therefore, the coverage can be restrictive, i.e. need-based. As you age, the probability of doctor visits may increase and thus, higher coverage is a must.

- The number of dependents: Health insurance is a tool to transfer the financial risk from a medical uncertainty. If more family members are dependent on you, you may go for a family floater plan to adequately cover all the family members as well as reduce the costs. The choice of the plan also defines the type of coverage you get. The choice of plan is affected by the number of relationships that you have.

- Financial Liabilities: An existing financial liability creates a stronger case to have a health insurance policy with sufficiently higher coverage. A debt-ridden person may not like to have another medical-related financial cash outflow, given that he is already struggling to clear the loans. In case of an uncertain medical emergency, you would prefer the medical costs to be borne by a third person, i.e. insurance company, so that you are free from the financial burden.

- Working risk profile: Working Profile is another crucial factor in determining the amount of coverage. If you are working in a coal mine, there is a higher vulnerability of catching air-borne disease because of continuous exposure to pollution. Another example will be if you are working under the danger of radiation, chemical abuse, high level of pollution, etc. You are very likely to get health issues earlier than anyone else. In short, the health insurance coverage is directly linked with the earlier onset of health problems in an individual.

- Family and hereditary medical background: If there are some hereditary diseases in your family, then you must cover yourself under a health insurance scheme. The coverage widens depending on your medical history and the family’s proneness to diseases.

- The anticipation of future medical costs: A health insurance premium has a validity of one year and may be renewed annually. However, the premium has to be paid for one year in advance. With rising medical costs, you must anticipate the medical inflation and calculate the coverage accordingly. If you are buying health insurance having coverage based on today’s situation may not be the best practices to follow.

- Type of insurance: You don’t need insurance for everything. You have to assess the likelihood and the impact of an event on your Health. If it is going to set your financial goals back by a substantial time-frame, you need to cover that in your insurance. Therefore, deciding the right type of plan also impacts insurance coverage.

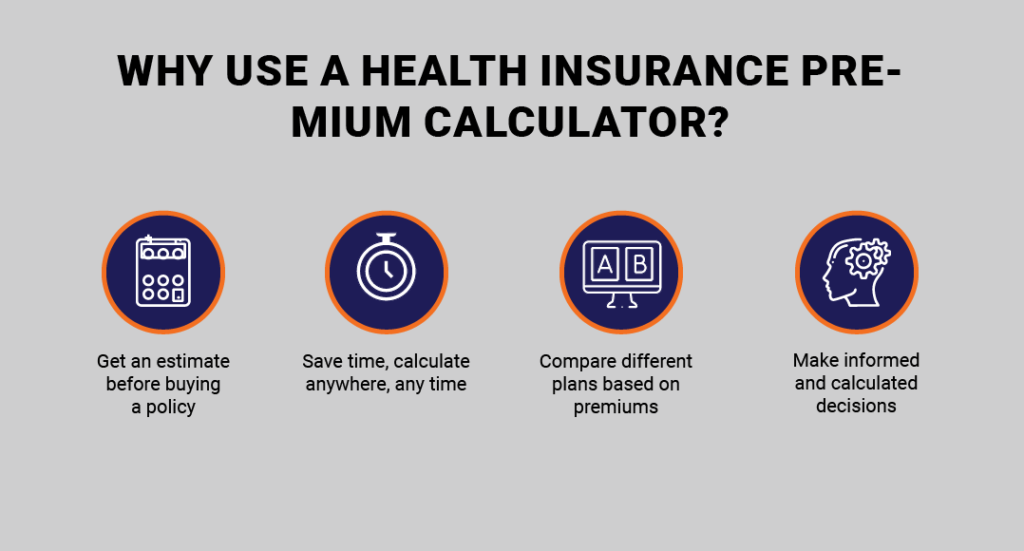

Learn with this infographic on health insurance premium calculators.

Conclusion

An individual should choose the best health insurance policy for themselves that is suitable for their needs and expectations and not just focus on the affordable premium rates available. They ought to select a policy such that it is a combination that has comprehensive health-related risk cover and is additionally cost-efficient. It is essential to assess the likelihood of the occurrence or non-occurrence of a particular event and evaluate the impact of that event on your health. This will answer most of your questions while buying insurance.

FAQs: Calculating Your Health Insurance Coverage

What questions to ask before buying an insurance policy?

There are many exciting changes in the insurance sector with a plethora of new features being continuously added to it. Some of the benefits include Lifetime Renewal Mandatory extended for all policies, etc. Insurance protects you from financial setbacks just in case of medical emergencies. Hence, it is important to be aware of the policy you are getting to opt for.

How will it help you? Before opting any policy, you should get some of these questions clarified:

1. How much sum insured under policy?

2. What is the coverage of the policy?

3. Family definitions.

4. Details about the claim paying process and the claims ratio.

5. Know about the history and standing of the insurance firm.

How can a smoker get an insurance policy and coverage?

While buying an insurance policy, the individual should give a declaration of his smoking habit to the insurance provider as smokers are classified as a high-risk category and it results in various diseases. So, it is sort of a red flag to the insurance provider.

A smoker can surely get an insurance policy, but the insurance does not pay cost stemming out of carelessness. It is the game of probability at the end of the day. It covers unwanted risks, not invited risks.

What expenses are covered under maternity insurance plans?

Maternity expenses are defined consistent with IRDA's circular issued in 2013. These expenses include any hospitalization expenses and a few more expenses discussed below:

1. Pre and Post Natal Expenses: It includes costs incurred before birth and after birth expenses.

2. Newborn Baby Cover (Day 1- 90): This includes coverage for costs associated with an infant's network, birth defect-related issues, and special medical procedures.

3. Vaccination Cover: Few insurers cover the prices of vaccinations which are mandated by the govt of India.

4. Pre-and Post-hospitalization expenses: generally, insurers also provide coverage for pre-and post-hospitalization costs incurred during maternity. The time-frame is typically set at 30 days for pre-hospitalization and 60 days for post-hospitalization.