Insurers in India: List of All Government/Private Insurance Companies 2021

Insurance Companies in India

Insurance is a tool of risk management wherein you can transfer your risk to the insurance company in exchange for a small consideration called the premium. Insurance, therefore, provides financial security to the policyholder which, ultimately leads to peace of mind. Insurance plans are, therefore, quite important for managing uncertain and unforeseen financial risks that might befall you.

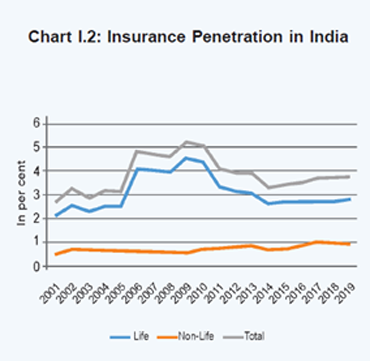

Though insurance is quite important, the awareness about its importance is low in India. We can measure the penetration and density of insurance in India to find out how receptive the Indian population is to insurance. Here’s a look into what insurance penetration and density actually mean:

Insurance Penetration

Insurance penetration is measured by assessing the aggregate premium collected by insurance companies against the GDP (Gross Domestic Product) of India. It is depicted as a percentage and a low percentage means a low premium collection thereby signifying that not many people invest in insurance.

Source: Swiss Re, Sigma, Various Issues.

Source: Swiss Re, Sigma, Various Issues.

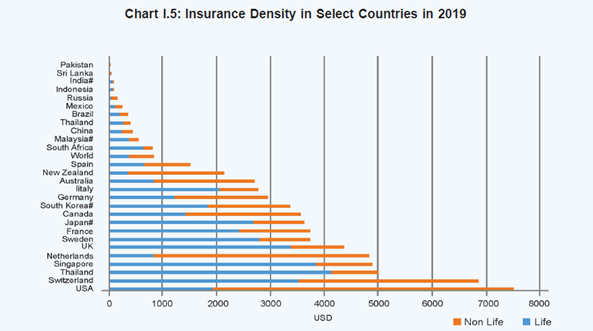

Insurance Density

Insurance density is expressed as a ratio of the total premium underwritten by insurance companies against the aggregate population. It shows the premium collected per person and a low figure indicates that not many people buy insurance policies.

According to the Annual Report published by the Insurance Regulatory and Development Authority of India (IRDAI), the penetration of insurance, as well as its density, is quite low in India though it has increased in recent times.

If you compare the penetration and density of other countries, India ranks quite at the bottom –

Source: Swiss Re, Sigma No. 4/2020.

Source: Swiss Re, Sigma No. 4/2020.

Note: 1. Insurance Density is measured as ratio of insurance premium to population. 2.# data relates to financial year

The importance of insurance is increasing as individuals are realising the need of having an insurance policy to guard against possible financial losses. An insurance policy covers a particular financial risk and compensates you for the financial loss suffered. Since there are different types of financial risks that you might face, there are different types of insurance policies designed for covering each specific risk so that you can keep yourself financially secured.

Types of Insurance

There are, however, two broad categorizations of insurance –

Each of these categories is further sub-divided into different types of plans.

Since there are two main categories of insurance plans, there are two types of insurance companies as well – life insurance companies and general insurance companies. Life insurance companies sell different forms of life insurance policies while general insurance companies sell different forms of general insurance policies. Let’s have a look at the insurers operating in the Indian insurance market.

- Life Insurance Company

- General Insurance Company

- StandAlone Insurance Company

Life insurance companies

Currently, there are a total of 24 life insurance companies in India out of which LIC is a Government-owned insurer while the rest are privately held companies. Let’s have a look at the list of life insurers and their top offerings –

General insurance companies

General insurance companies are those that offer a variety of non-life insurance solutions like health insurance, motor insurance, travel insurance, and other commercial insurance products. General insurers can be further sub-divided into two –

- General insurance companies

- Standalone health insurance companies

While general insurance companies offer a range of insurance solutions, standalone insurers offer only health-related insurance plans. Let’s have a look at the list of general and standalone insurance companies operating in the market.

General insurance companies

Standalone health insurance companies

Now, let’s have a look at the general insurance companies that sell only health insurance plans. These companies are as follows -

Frequently Asked Questions

1. How many insurance companies are owned by the Government of India?

In the life insurance segment, only LIC is owned by the Government of India. However, in the general insurance segment, four insurance companies are owned by the Government which are The New India Assurance Company, National Insurance Company, The Oriented Insurance Company and The United India Insurance Company.

2. Can I buy policies from both life and general insurance companies?

Yes, you can buy as many policies from life and general insurance companies. Since you face different types of financial risks, you need both life and general insurance plans to protect against such risks.

3. What is the meaning of the Claim Settlement Ratio?

The Claim Settlement Ratio of life insurers is the percentage of the number of claims settled by the insurance company against the total number of claims made on it. A high ratio is favourable since it indicates that the company settles most of its claims and is trustworthy.

4. What is the meaning of Incurred Claims Ratio?

The Incurred Claim Ratio is calculated for general insurance companies. It measures the amount of claim paid vis-à-vis the amount of premium collected by the insurance company in one financial year. A ratio of more than 100% means that the company paid more in claims than it collected in premiums and thus, the company made a loss. An ICR of more than 100%, consistently, is not favourable for the insurance company. A lower ICR, on the other hand, shows that the company is making a lot of profit from the premium collection as its claim pay-out is low.

5. Who publishes the claim ratios of insurance companies?

The Incurred Claim Ratio is calculated for general insurance companies. It measures the amount of claim paid vis-à-vis the amount of premium collected by the insurance company in one financial year. A ratio of more than 100% means that the company paid more in claims than it collected in premiums and thus, the company made a loss. An ICR of more than 100%, consistently, is not favourable for the insurance company. A lower ICR, on the other hand, shows that the company is making a lot of profit from the premium collection as its claim pay-out is low.

6. What should I do in case of any dispute with any insurance company?

To handle disputes or complaints insurance companies have created grievance redressal departments which you can contact. If not satisfied with the insurer’s solution, you can reach out to the insurance Ombudsman or even take your dispute to the consumer forum or the judicial courts of India.